Jul 14, 2011 - 02:12 PM

By: Jim_Willie_CB

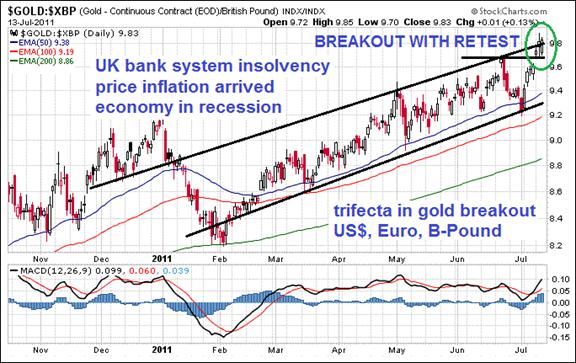

GOLD BREAKOUT IN MAJOR CURRENCIES

The gold breakout slams the Western bankers with all their chicanery in naked shorts of Gold & Silver, chicanery in dumping crude oil from reserves, chicanery in debt monetization of USTBonds, and chicanery in doctored economic reports. The crumbling monetary system continues. The sovereign debt contagion is in the process of jumping from Greece to Italy, a major escalation of bank risk and regional crisis. Spain is next. For context, consider that Italy is three times larger than Greece, Portugal, and Ireland combined. Italy has the largest debt burden and highest debt ratio in all of Europe. Italy has almost 60 million in population, six times larger than Greece. The grand daddy of all risk is the United States. Apart from the baseline risk of exceeding a rigidly enforced debt limit, the US looks remarkably like Greece in debt ratios. To be more accurate, the US is Greece times one hundred. Just as insolvent as a nation like Greece, just as absent in a fundamental industrial base. The second half recovery mantra nonsense in the USEconomy has been blatant propaganda for five years running. The second half will feature a powerful Gold & Silver breakout rally that will blow the socks off the public and investment community, and blow brown particulate matter with excretory chunks on banker faces. The keys are debt virus hitting Italy and Spain in Europe, and the recession accelerating in the United States. The US housing market is stuck in terminal decline, dragging down the big US banks which have toxic homes on their balance sheets. The kicker is the debt limit debate, and gross incompetence and lack of leadership exhibited within the USGovt.

Gold has broken out in US$ terms. The Gold price has extended gains to $1594 today. It is a CH away from $1600. Notice the wonderful W-shaped bullish reversal pattern. The double bottom has been established and retested. With a boxed low of 1475 and high of 1565, look for a target of 1655 in gold. Discount all talk from Wall Street on the Gold price. They are defending attacks on their own bunkers loaded still with toxic paper, together with court attacks to win restitution on mortgage bond fraud, even raiding their Loan Loss Reserves to augment profit stories. The clownish Bernanke actually told the USCongressional committee this week that gold was not money, contrary to a Greenspan position. Bernanke is an utter dolt, a hack financial engineer, a mad paper merchant, an ink salesman, a journeyman paper shuffler, a destroyer of capital. Gold is banking system ballast, absent since 1971, when the cost of the Vietnam War forced the Nixon Admin to abandon the Gold Standard and to defy foreign claims. The offshore exodus of Intel and other tech firms to the Pacific Rim produced a trade gap that forced the issue. The US is officially isolated. The Euro Central Bank is focused on price inflation, hiking rates. The USFed is focused on growth, stuck at the 0% rate. A great monetary schism is in progress. The rating agencies have decided reluctantly to do their job. To have USGovt debt at AAA is like calling a hurricane a bright sunny day, like giving the stupidest kid in class straight A grades, like having Ugly Betty win as the prom queen, like naming the Pittsburgh Pirates as baseball's best.

Gold has broken out in Euro currency terms. It is powerful and convincing, not too surprising since the sovereign debt crisis has its center stage in Europe. Notice the gigantic bullish triangle that has formed over the last several months. An impulse low of 9.65 and resistance of 10.85 yields a target of 1200 for Gold in Euro terms. A gap exists between 10.85 and 11.0, which should fill, maybe not, but probably yes. That is the European final entry opportunity for Gold investors. The Gold breakout in US$ terms and Euro terms makes for a strong confirmation. A potential wild card ugly might lie on the money market horizon in Europe, based in USDollars. It is on the verge of blowing up.

Gold has broken out in British Pound currency terms. That completes the trifecta in gold breakout in three major currencies. The UK banking system is in ruins. The UKEconomy is in deadly decline. Price inflation has arrived. Rupert Murdoch has provided a nice distraction in London, much bigger than Manchester United. The Gold price is flirting with a breakout in Canadian Dollar terms. There is no semblance of Gold breakout in either Swissie terms or Aussie Dollar terms, where the currencies are too strong. Prepare for a massive bull rally in both Gold & Silver from July through January. The yellow metal as usual will fight the political and banker battles and clear the path for the white horse metal to sprint. The Silver price gains in US$ terms will continue to triple the Gold price gains, but Silver must be given a little time to overcome the spiked springtime top near $50. All in time. The Commitment of Traders report on commercial positions indicates that Silver is ready to rock & roll once again. A very hot autumn is coming from precious metals, their annual strong season. Fireworks a plenty are in store. The global monetary system is crumbling, whose sovereign debt foundation is collapsing. It is that simple. Money is in ruins. Greece and Italy serve as detonation.

http://www.marketoracle.co.uk/Article29265.html

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

No comments:

Post a Comment