April 2011

Forex Commentary:

The euro slipped on Friday but its uptrend of the past three months still looks intact, with the prospect of more interest rate increases from the European central bank seen offsetting concerns about the ability of some poorer euro zone countries to pay their debts.

The euro is up nearly 8.0 percent against the U.S. dollar and 10.4 percent versus the yen in 2011, helped by interest rate differentials with the the short end of the euro zone yield curve significantly above the U.S. yield curve.

The yen has risen in six of the last seven sessions and was on track for best weekly performance against the dollar in about nine months with gains this week of 2.1 percent.

Trading Setups / Chart in Focus:

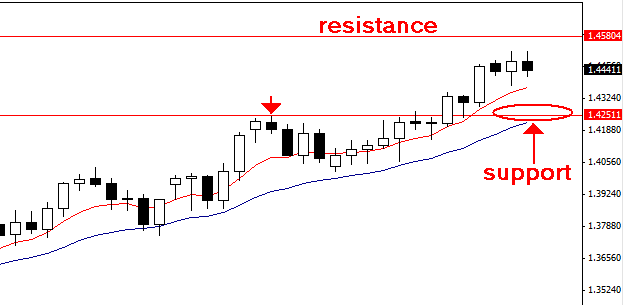

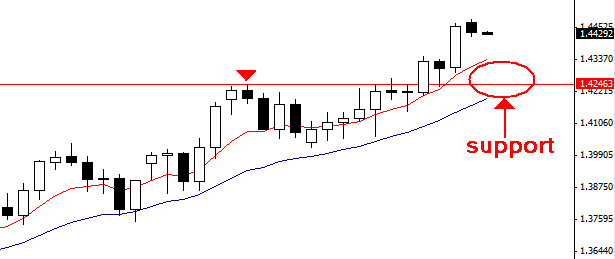

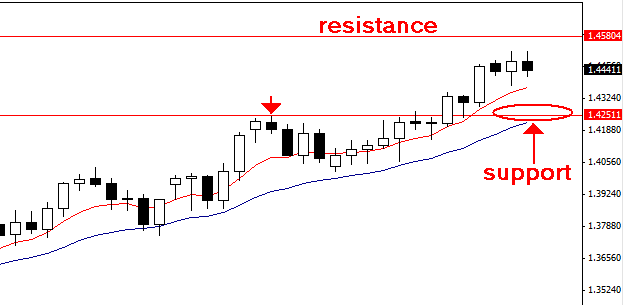

EURUSD

The EURUSD consolidated this week, but it did maintain its buoyancy by closing above the 8 day EMA everyday this week.

Support sits near 1.4250 and the 21 day EMA, should we get a rotation lower into this value area, we would watch closely for bullish price action setups to rejoin the uptrend. If price pushes higher there is a weekly resistance near 1.4580 that it must break through to establish another leg higher.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my price action forex course.

Other Markets:

On Wall Street today U.S. stocks moved higher on the back of encouraging economic indicators, however the market’s recent struggles could continue next week as more than one-fifth of S&P 500 companies will report results.

The Dow added 56.68 points, or 0.46 percent, the S& 500 added 5.16 points, or 0.39 percent, and the Nasdaq gained 4.43 points, or 0.16 percent.

Upcoming important economic announcements: 4/17/2011

6:45pm EST: New Zealand – CPI q/q

4/18/2011

9:30pm EST: Australia – Monetary Policy Meeting Minutes

This will be the most important Forex trading article you ever read. That might sound like a bold statement, but it’s really not too bold when you consider the fact that proper money management is the most important ingredient to successful Forex trading.

Continue Reading Risk Reward and Money Management in Forex TradingForex Commentary:

The U.S. dollar weakened across the board on Thursday, reaching a record low against the Swiss franc, with more losses likely as long as U.S. Federal Reserve and European Central Bank policies continue to diverge.

The dollar also weakened today as a result of a government report showing that unemployment benefits in the U.S. rose unexpectedly.

The euro has gained 8.3 percent on the dollar in 2011 even with events that would typically be negative for the currency, such as uprisings in the Middle East and Japan’s earthquake.

In other trading, the British pound rose to $1.6353 from $1.6274. The dollar fell to 83.54 Japanese yen from 83.82 yen, and fell to 0.8925 Swiss franc from 0.8963 Swiss franc.

Trading Setups / Chart in Focus:

Silver

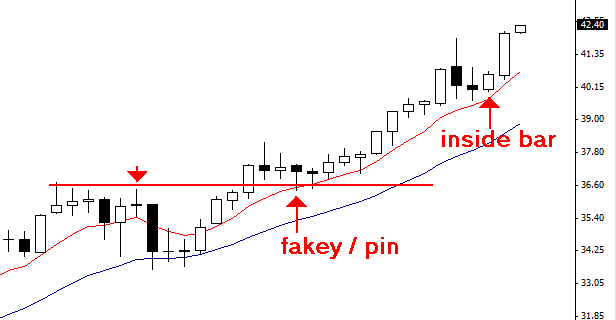

The silver market continued to flex its muscle today as an inside bar setup from yesterday fired off to the upside.

We discussed this inside bar trading strategy yesterday in our member’s commentary, and some of our member’s have been riding this silver trend for a quite a while now, taking advantage of the price action strategies that have been forming.

Both silver and gold have been very strong recently as the U.S. dollar continues to weaken and global demand for the precious metals continues to rise.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my forex trading course.

Other Markets:

On Wall Street today stocks eked out small gains as concerns about faltering growth and inflation caused investors to hesitate on taking bigger risks.

The Dow added 14.16 points, or 0.12 percent, the S&P 500 gained 0.11 of a point, or 0.01 percent, and the Nasdaq lost 1.30 points, or 0.05 percent.

Upcoming important economic announcements: 4/15/2011

8:30am EST: United States – Core CPI m/m

9:00am EST: United States – TIC Long-Term Purchases

9:55am EST: United States – Prelim UoM Consumer Sentiment

Forex Commentary:

The EURUSD fell from a 15-month high on Wednesday on technical selling and after U.S. President Barack Obama unveiled deficit cuts that were deemed positive for the U.S. dollar.

Overall sentiment toward the greenback, however, remains largely bearish given expectations the U.S. Federal Reserve will significantly lag global central banks in raising interest rates.

Also, on Tuesday a drop in commodity prices dented sentiment toward the Australian dollar, which ended trading near $1.0435. But the Aussie bounced back on Wednesday, buying $1.0506 in recent action.

Trading Setups / Chart in Focus:

EURUSD

The EURUSD took a breather today from its recent ascent. The pair consolidated just above its 8 day EMA and just below a long-term resistance level at 1.4580.

Should price rotate lower in the near-term we will watch the support at 1.4250, near the 21 day EMA, for potential bullish price action trading setups to rejoin the uptrend.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my forex trading price action course.

Other Markets:

On Wall Street today stocks rose in choppy trading conditions as investors bet that earnings from technology companies will be strong, even as JPMorgan Chase’s numbers caused other market sectors to fall.

The Dow added just 7.41 points, or 0.06 percent, the S&P 500 rose just 0.25 of a point, or 0.02 percent, and the Nasdaq added 16.73 points, or 0.61 percent.

Upcoming important economic announcements: 4/14/2011

8:30am EST: United States – PPI m/m

8:30am EST: United States – Unemployment Claims

All Day: G7 Meetings

10:00pm EST: China – CPI y/y

10:00pm EST: China – GDP q/y

Forex Commentary:

The Japanese yen and Swiss franc gained about 1 percent against the U.S. dollar on Tuesday amid heightened risk aversion due to Japan’s nuclear crisis and a slide in U.S. stocks.

The move into safe havens forced many investors to unwind carry trades, strengthening the yen and also bolstering the Swiss franc.

The yen rose for a fourth consecutive session against the dollar, partly retracing 10 consecutive days of losses. The Swiss franc also advanced for a fourth straight day against the greenback.

The euro rose above $1.45 to a 15-month high against the dollar today, boosted by reports of buying from China and news the world’s second largest economy was willing to purchase more Spanish government debt.

Trading Setups / Chart in Focus:

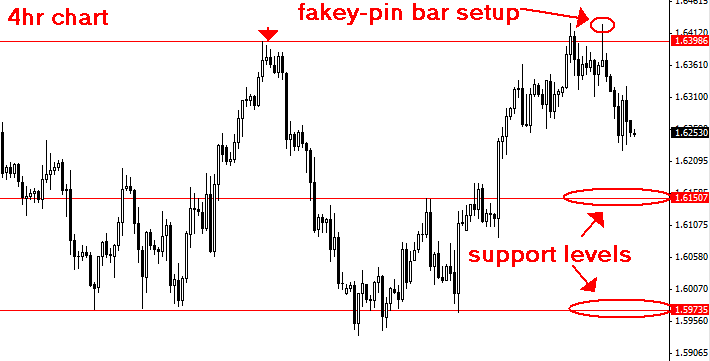

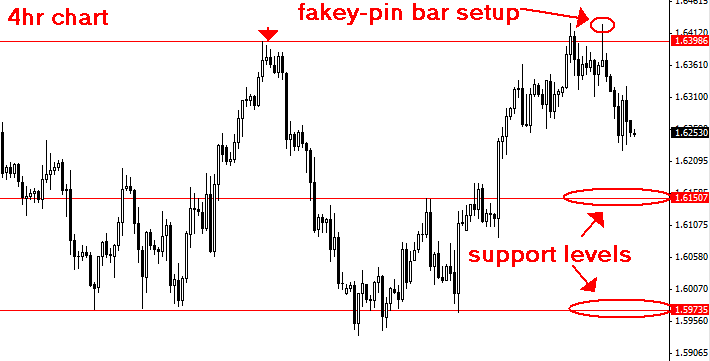

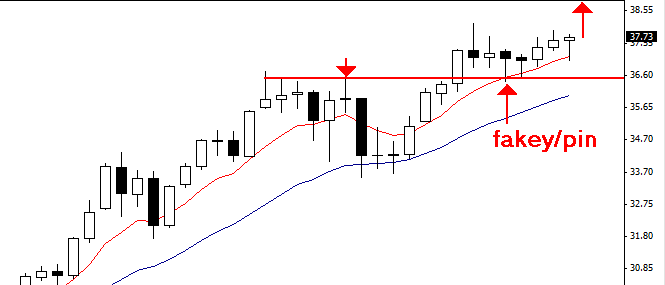

GBPUSD

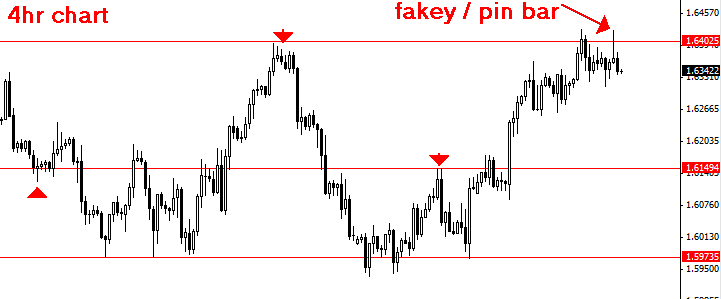

The GBPUSD fakey-pin bar strategy that we discussed yesterday has come off nicely to the downside, providing a reward of about two times risk already. As we discussed yesterday this setup formed showing rejection of the significant resistance level near 1.6400 and was also a well-defined price action setup.

We can see two obvious support levels coming up soon, one near 1.6150 and the other one down near 1.5975 that could cause price to bounce higher. Anyone still short should watch these support areas closely.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my price action trading course.

Other Markets:

On Wall Street today stocks fell lower on the back of worries that falling oil prices could set off a reversal in the recent strength seen in the energy sector.

The S&P Energy Index was down 3 percent as energy stocks led the S&P 500’s losses.

The Dow lost 117.53 points, or 0.95 percent, the S&P 500 dropped 10.30 points, or 0.78 percent, and the Nasdaq dropped 26.72 points, or 0.96 percent.

Upcoming important economic announcements: 4/13/2011

4:30am EST: Britain – Claimant Count Change

8:30am EST: United States – Core Retail Sales m/m

8:30am EST: United States – Retail Sales m/m

10:30am EST: Canada – BOC Monetary Policy Report

11:15am EST: Canada – BOC Press Conference

1:00pm EST: Australia – RBA Gov Stevens Speaks

Forex Commentary:

The U.S. dollar paused from last week’s sharp decline against the euro on Monday, but a strong bearish stance toward the greenback is seen persisting ahead of next month’s U.S. debt limit debate and on global central bank monetary policy disparities.

The dollar’s negative tone should remain in place as long as the U.S. Federal Reserve keeps interest rates low and while central banks abroad, namely the ECB and Bank of England, move closer to more normal borrowing costs, analysts said.

The yen, meanwhile, was off an 11-month low against the euro and a 2-1/2-year trough versus the Australian dollar as yet another earthquake in Japan led some investors to pare bearish bets against the country’s currency.

Trading Setups / Chart in Focus:

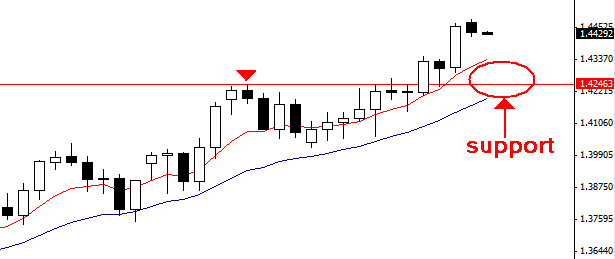

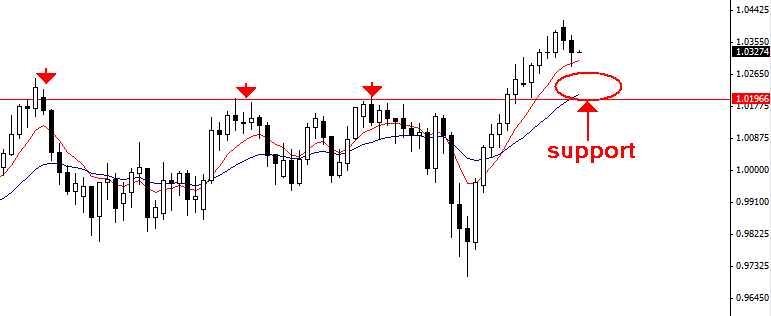

EURUSD

The EURUSD stalled today after last Friday’s strong push higher from the inside pin bar setup that formed last Thursday.

We see the possibility of a rotation lower into value near the 8 or 21 day EMA in the near-term. Should this take place we will watch for bullish price action setups to provide a long entry back into the dominant up-trend.

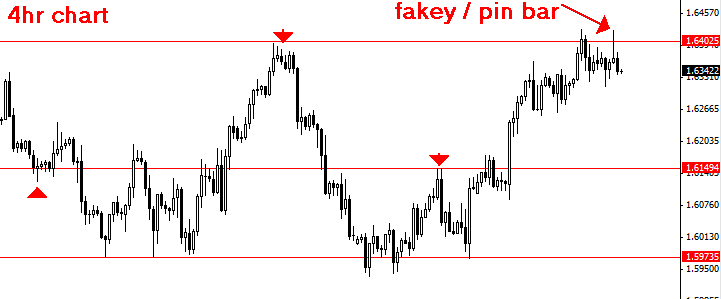

GBPUSD

The GBPUSD formed a bearish fakey pin bar strategy on the 4 hour chart today. This setup is counter to the recent bullish momentum, but it is well-formed and at a significant resistance level, so we still could see this market fall lower from today’s fakey setup before the bullish sentiment picks back up.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my price action trading course.

Other Markets:

On Wall Street today stocks were mostly lower as shares of energy companies sold off on the back of falling oil prices and the beginning of earnings season which was clouded by worries that company outlooks may fall short of expectations.

The Dow added 1.06 points, or 0.01 percent, the S&P 500 lost 3.71 points, or 0.28 percent, and the Nasdaq dropped 8.91 points, or 0.32 percent.

Upcoming important economic announcements: 4/12/2011

4:30am EST: Britain – CPI y/y

5:00am EST: Euro-zone – German ZEW Economic Sentiment

8:30am EST: Canada – Trade Balance

8:30am EST: United States – Trade Balance

9:00am EST: Canada – BOC Rate Statement

9:00am EST: Canada – Overnight Rate

Forex Commentary:

The euro rose to a 15-month peak versus the dollar on Friday, on pace for a gain of 1.7 percent this week. The prospect of a U.S. government shutdown, which would idle about 800,000 federal government workers and put a crimp in the economic recovery, weighed on the dollar.

Speculators cut bets in favor of the yen this week, going short the Japanese currency by the biggest margin in nearly a year, data showed on Friday, and built up a record long position in the Australian dollar.

The Australian dollar rose to $1.0552, its highest level versus the greenback since it was floated in December 1983. The aussie has benefited from strong domestic economic growth, staving off the malaise of the rest of the developed world in recent years, fueled in large part by exports of raw materials to China.

Trading Setups / Chart in Focus:

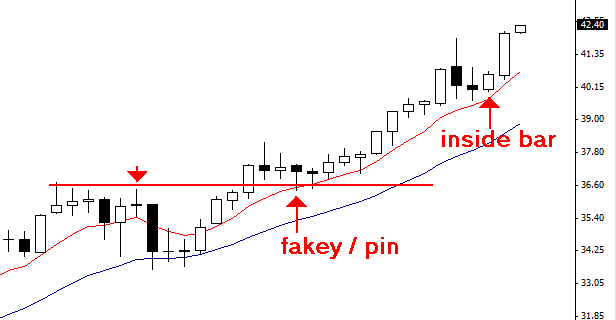

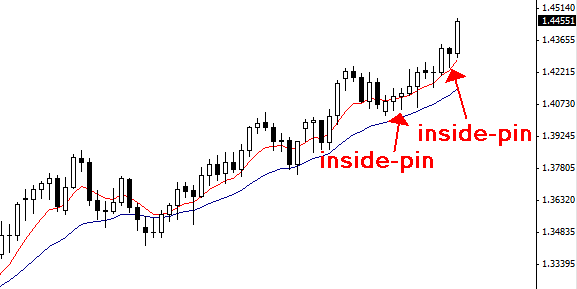

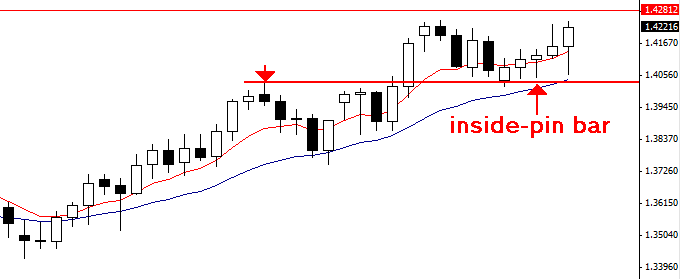

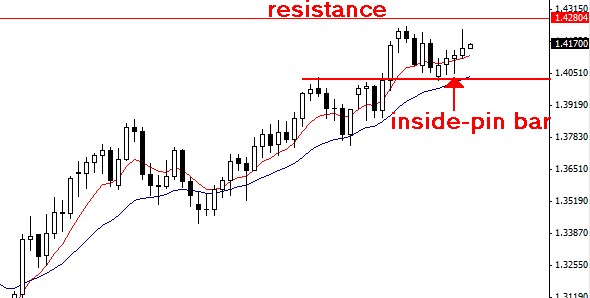

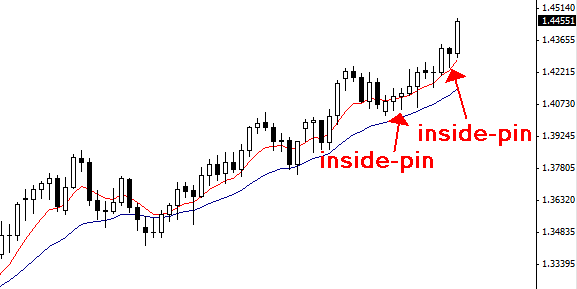

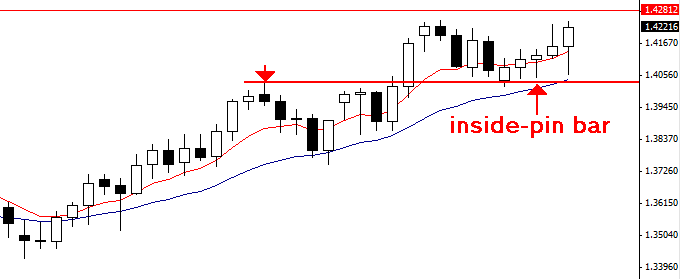

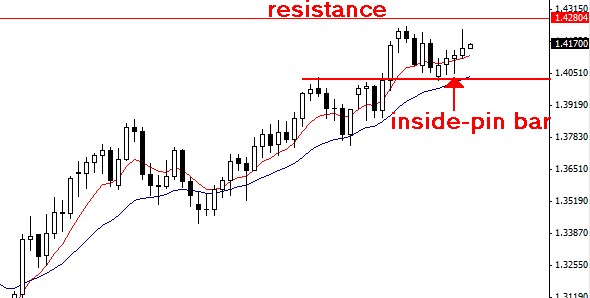

EURUSD

The EURUSD pushed higher today and broke out from yesterday’s inside pin bar setup which we discussed in the member’s commentary last night.

We can see this chart has been very strong lately, the inside-pin bar trading strategy from March 30th has provided price action traders with some serious gains, moving about 300 pips to the upside since it broke higher.

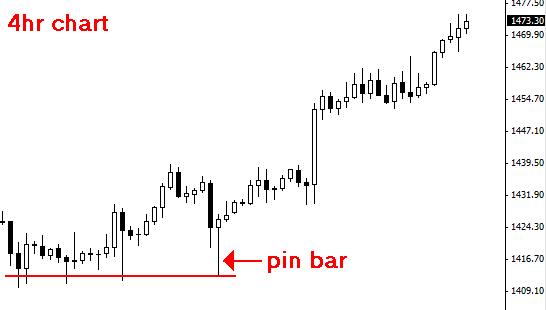

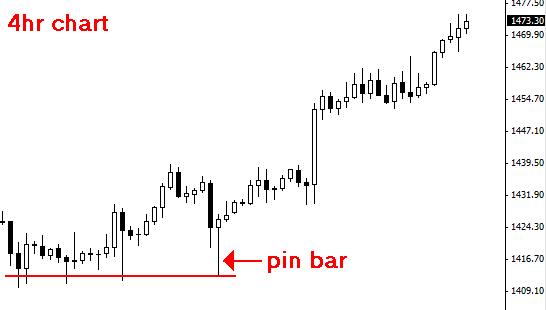

Gold – 4hr chart

The 4hr gold chart fired off a very nice pin bar strategy on April 1st that has since moved significantly higher. This was a well-defined pin bar that formed in the direction of the dominant trend and had rejected an obvious support level.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my price action forex trading course.

Other Markets:

On Wall Street today stocks fell late after a spike in oil prices revived concerns that inflation would derail the recovery. Also, the uncertain budget talks in Washington and the prospect of a U.S. government shutdown spurred investors to buy safety ahead of the weekend.

The Dow lost 29.59 points, or 0.24 percent, the S&P 500 lost 5.36 points, or 0.40 percent, and the Nasdaq lost 15.73 points, or 0.56 percent.

Ultimately, no matter what your specific situation is, you should aim to design your Forex trading room or office with just the right combination of practicality and comfort. This article will teach you how to set up your trading room or office and adjust your lifestyle to achieve optimal trading results.

Continue Reading Setting Up A Forex Trading Room To Improve Trading ResultsForex Commentary:

The EURUSD stalled today, falling from a 14-month high after the European Central Bank weakened the picture for aggressive interest rate hikes, however pullbacks to the downside are expected to be limited.

The yen gained strength today against the other majors after a new earth quake in Japan cause investors to close trades in riskier assets which were funded by the cheaply borrowed yen.

Sterling slipped against the dollar after the Bank of England kept rates unchanged, as expected.

Trading Setups / Chart in Focus:

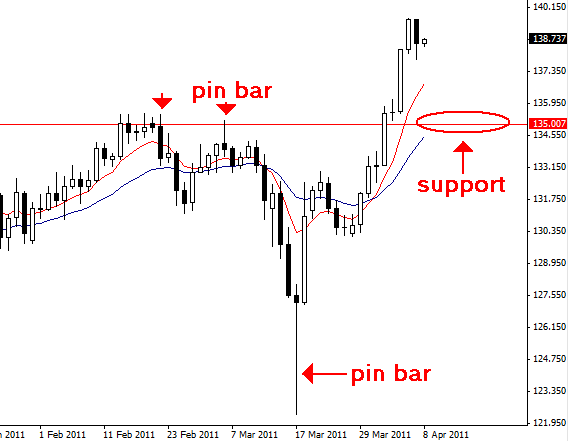

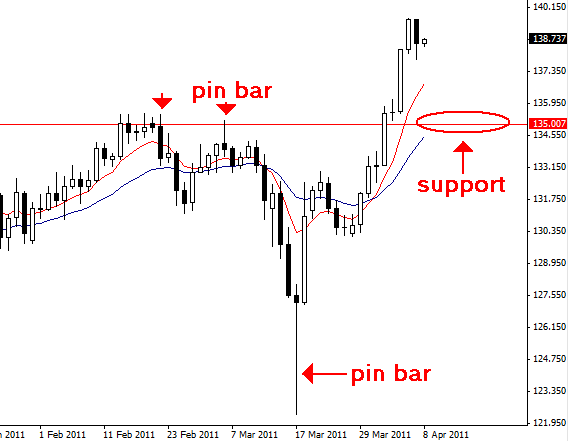

GBPJPY

The GBPJPY has had quite an impressive move since the long-tailed pin bar which formed back on March 17th came off aggressively to the upside.

We can see an obvious support level coming in near 135.00 that would be a good area to watch for potential bullish price action strategies to form near, should price fall lower in the near-term.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my price action forex trading course.

Other Markets:

On Wall Street today stocks fell lower after a major aftershock in Japan reignited fears about its nuclear crisis, however, positivity about the U.S. economy worked to limit losses.

The Dow lost 17.26 points, or 0.14 percent, the S&P 500 lost 2.03 points, or 0.15 percent, and the Nasdaq dropped 3.68 points, or 0.13 percent.

Upcoming important economic announcements: 4/8/2011

4:30am EST: Britain – PPI Input m/m

7:00am EST: Canada – Employment Change

7:00am EST: Canada – Unemployment Rate

8:15am EST: Canada – Housing Starts

Forex Commentary:

The euro rose on Wednesday to a 14-month high against the dollar on speculation the European Central Bank will signal further interest rate rises following an expected increase this week, though there’s room for disappointment.

The yen slid to an 11-month low against the euro and a six-month low against the dollar.

The high-yielding Australian dollar AUDJPY surged to 89.28 yen, its highest since September 2008, with 90 yen seen as the next possible target.

Trading Setups / Chart in Focus:

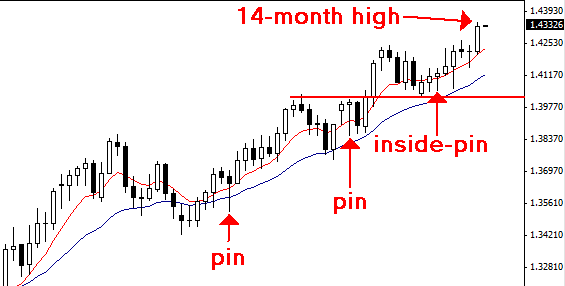

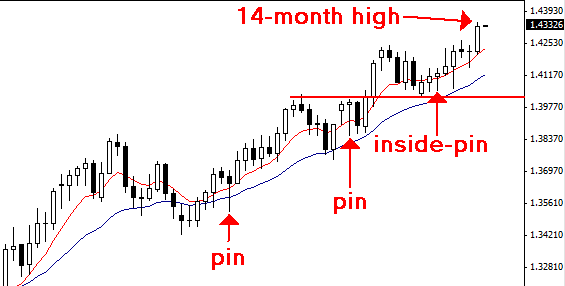

EURUSD

In our commentary from March 30th we discussed an inside pin bar trading strategy that formed on the daily chart of the EURUSD, and the possibility of price breaking higher from the setup and re-testing resistance near 1.4280.

Today, price hit a 14-month high as it broke through the resistance at 1.4280, closing the day around 1.4330. We can see that the inside-pin bar setup discussed in the commentary from last week was just one of a few different price action setups that have provided savvy traders with an excellent opportunity to ride this recent uptrend in the EURUSD. This market is still looking bullish overall and pullbacks to value could be viewed as buying opportunities pending price action confirmation.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my forex price action trading course.

Other Markets:

On Wall Street today stocks pushed higher with caution as investors avoided making big bets ahead of earnings.

The Dow gained 32.85 points, or 0.27 percent, the S&P 500 added 2.91 points, or 0.22 percent, and the Nasdaq gained 8.63 points, or 0.31 percent.

Upcoming important economic announcements: 4/7/2011

Tentative: Japan – BOJ Press Conference

7:00am EST: Britain – Asset Purchase Facility

7:00am EST: Britain – Official Bank Rate

Tentative: Britain – MPC Rate Statement

7:45am EST: Euro-zone – Minimum Bid Rate

8:30am EST: Canada – Building Permits m/m

8:30am EST: Euro-zone – ECB Press Conference

8:30am EST: United States – Unemployment Claims

Forex Commentary:

The U.S. dollar fell against the euro today after minutes from the Federal Reserve’s meeting last month indicated that there probably won’t be a hike in interest rates anytime soon.

The euro has been climbing most of the year, gaining nearly 3 percent since early March and hitting a five-month high on Monday. Investors expect the European Central Bank to raise the key interest rate for the 17 countries that use the euro to 1.25 percent from 1 percent, where it has stood since May 2009, because of the threat of inflation from climbing energy and food prices. The ECB meets on Thursday.

The dollar was mixed in other trading today after a report from the Institute for Supply Management showed the service sector expanded at a slower pace in March than in February. The dollar gained to 84.88 Japanese yen from 84.04 yen, but the British pound rose to $1.6294 from $1.6125.

The U.S. currency dipped to 96.33 Canadian cents from 96.77 Canadian cents, and rose to 0.9260 Swiss franc from 0.9235.

Trading Setups / Chart in Focus:

AUDUSD

The AUDUSD fell lower today, and the last two days have seen the pair stall out after its recent impressive upside move.

Should price continue to rotate lower into value, we would watch support near the 21 day EMA and the horizontal level of 1.0200 for potential bullish price action forex trading strategies to rejoin the overall uptrend.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my forex trading course.

Other Markets:

On Wall Street today the S&P 500 could not break through resistance again at a key technical level as low trading volume caused concern about the market’s strength.

The Dow lost 6.13 points, or 0.05 percent, the S&P 500 dropped just 0.24 point, or 0.02 percent, and the Nasdaq gained 2.00 points, or 0.07 percent.

Upcoming important economic announcements: 4/6/2011

4:30am EST: Britain – Manufacturing Production m/m

10:00am EST: Canada – Ivey PMI

9:30pm EST: Australia – Employment Change

9:30pm EST: Australia – Unemployment Rate

Tentative: Japan – Monetary Policy Statement

Tentative: Japan – Overnight Call Rate

Forex Commentary:

The euro edged lower on Monday after hitting a five-month peak against the U.S. dollar and an 11-month high against the yen, with near-term strength seen limited as an expected euro zone interest rate rise was mostly priced in.

Traders expect the euro to stay near current levels in the coming days, with resistance seen around $1.4281, the November high. The single currency could struggle to extend gains unless ECB President Jean-Claude Trichet sounds a surprisingly hawkish tone on inflation, analysts said.

Trading Setups / Chart in Focus:

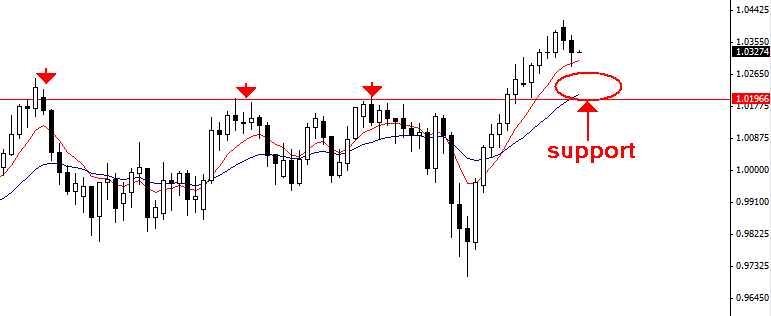

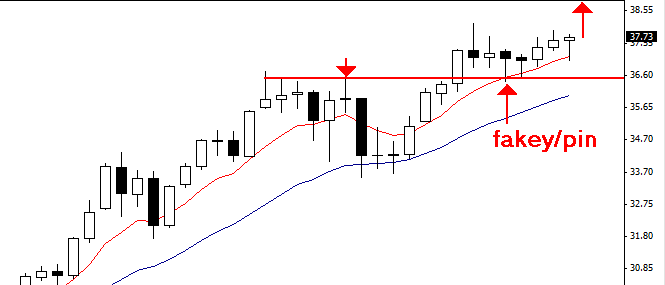

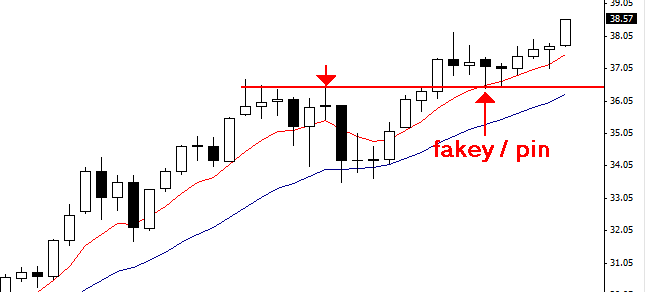

Silver

Silver pushed higher today on the back of the bullish price action that formed last week. In Friday’s commentary we discussed the fakey pin bar strategy that formed early last week in the spot silver market.

We can see in the chart below that the fakey has come off nicely to the upside and prices look very strong in the silver market with today closing near the highs and no resistance in sight.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my price action Forex trading course.

Other Markets:

On Wall Street today the S&P 500 ran into resistance and failed to break through a level that has held since mid-February.

Based on the latest available data at the time of this writing, the Dow added 23.31 points, or 0.19 percent, the S&P 500 added just 0.46 of a point, or 0.03 percent, and the Nasdaq lost only about 0.41 of a point, or 0.01 percent.

Upcoming important economic announcements: 4/5/2011

12:30am EST: Australia – Cash Rate

12:30am EST: Australia – RBA Rate Statement

4:30am EST: Britain – Services PMI

10:00am EST: United States – ISM Non-Manufacturing PMI

2:00pm EST: United States – FOMC Meeting Minutes

9:30pm EST: Australia – Home Loans m/m

Forex Commentary:

The addition of more than 200,000 U.S. jobs wasn’t enough to boost the dollar against the euro on Friday, and the greenback may have more losses in store as markets brace for a euro zone interest rate hike next week.

However, the employment report, which also showed the U.S. jobless rate slipping to 8.8 percent last month, did push the dollar above 84 yen, its highest in more than six months, as traders expect Japanese interest rates to stay at a record low.

Trading Setups / Chart in Focus:

EURUSD

The EURUSD inside pin bar trading strategy that we first discussed in Wednesday’s commentary has come off to the upside, however, price did fall lower early in today’s session but it did not violate the pin bar low and it quickly reversed to close out this week near the highs. We can see resistance from November 2010 is coming in close overhead.

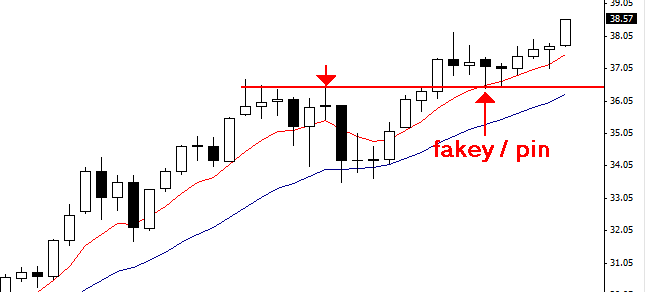

Silver

Silver did not move very far this week but it did manage to close above its 8 day EMA every day and is showing signs of building momentum for the possibility of another leg higher.

We can see a fakey pin bar strategy formed early this week, and today formed a bullish pin bar that rejected the 8 day EMA dynamic support. If price can break above $38.16 we may see a stronger upside push next week.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my price action Forex course.

Other Markets:

On Wall Street today U.S. stocks started off the new quarter with a solid performance on the back of positive jobs figures. However, the S&P 500 is nearing multi-year highs and may encounter some resistance in the near-term.

The Dow rose 56.99 points, or 0.46 percent, the S&P 500 added 6.58 points, or 0.50 percent, and the Nasdaq gained 8.53 points, or 0.31 percent.

Upcoming important economic announcements: 4/3/11

9:30pm EST: Australia – ANZ Job Advertisements m/m

4/4/11

10:30am EST: Canada – BOC Business Outlook Survey

6:00pm EST: New Zealand – NZIER Business Confidence

7:15pm EST: United States – Fed Chairman Bernanke Speaks

9:30pm EST: Australia – Trade Balance

Understanding how to implement Forex trading money management to grow your trading account is essential to the success of all traders. However, many beginning traders are largely unaware of some or most of the basic concepts of effective Forex money management, and this is a major reason why so many traders fail to make money over the long-term in the markets

Continue Reading Nial Fuller’s 5 Golden Rules of Forex Trading Money ManagementForex Commentary:

The euro climbed against the dollar Thursday as an inflation reading in Europe bolstered investor expectations that the European Central Bank will raise interest rates next week.

In other trading Thursday in New York, the British pound fell to $1.6025 from $1.6069 late Wednesday. The dollar rose to 83.11 Japanese yen from 82.89 yen, and rose marginally against the Swiss franc. The U.S. dollar closed basically unchanged against the Canadian dollar and Australian dollar.

Investors are awaiting Friday’s unemployment report to see whether the economy added jobs in March. Economists forecast that employers added a net total of 185,000 jobs during the month.

Trading Setups / Chart in Focus:

EURUSD

The EURUSD inside-pin bar setup that we discussed in yesterday’s commentary got triggered to the upside today, however price did pullback a bit into the New York close, but overall we are still seeing the potential for a re-test of resistance near 1.4280 in the near-term.

Note how the inside-pin bar setup formed just above the 21 day EMA, showing rejection of the 1.4030 support area and in-line with the broader up-trend, adding confluence to the setup.

For a more in-depth analysis of the major forex currency pairs and price action analysis, please check out my forex trading course.

Other Markets:

On Wall Street today stocks ended the quarter on a quiet note as investors looked ahead to Friday’s U.S. jobs report to provide a catalyst for continued growth.

The Dow lost 30.88 points, or 0.25 percent, the S&P 500 dropped 2.43 points, or 0.18 percent, and the Nasdaq gained 4.28 points, or 0.15 percent.

Upcoming important economic announcements: 4/1/11

3:15am EST: Switzerland – Retail Sales y/y

4:30am EST: Britain – Manufacturing PMI

8:30am EST: United States – Non-Farm Employment Change

8:30am EST: United States – Unemployment Rate

10:00am EST: United States – ISM Manufacturing PMI