Tuesday 23 August 2011

The 1% and 2% rules for the gold price

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Bob Chapman "Gold is not going to stop at $2000/oz" - The Financial Survival 22 Aug 2011

for more Bob Chapman videos

Bob Chapman - The Financial Survival 22 Aug 2011

MONDAY, AUGUST 22, 2011

Bob Chapman : Gold is not going to stop at $2000/oz

BOB CHAPMAN - THE FINANCIAL SURVIVAL 22 AUG 2011

Bob Chapman : I see that they have invaded Mr Ghaddafi and they probably might capture him and the first thing , they are going after his Gold , I do not think it is going to be sold in the market they know it is going to go much higher they know they can't impede it except for using derivatives and they do not want to lose that gold but they are going to steal , the operative word is STEAL , they are nothing but criminals they are worse than Gingis Khan ,,,Gold is not going to stop at 2000 , I think it is going to blow right throw it , I am going to be a buyer as I told you I do not care what the price is just BUY......110822 - Hyper Report

by HyperReport on Aug 22, 2011

Source Links for Today's Items:

Stocks Rally on Expectations for Stimulus

http://www.bloomberg.com/news/2011-08-22/u-s-index-futures-fall-oil-drops-on-...

Federal Reserve Lent Private Banks $1.2 Trillion During Financial Crisis' Acute Stage

http://www.ibtimes.com/articles/201365/20110821/federal-reserve-banks-banking...

Jobs: Worse Than You Think

http://money.cnn.com/2011/08/08/news/economy/unemployment_jobs/index.htm

Obamacare is Already On Its Deathbed

http://campaign2012.washingtonexaminer.com/article/obamacare-already-its-deat...

Social Security Disability on Verge of Insolvency

http://news.yahoo.com/social-security-disability-verge-insolvency-090119318.html

South Dakota Schools Cut Costs With 4-day Week

http://hosted.ap.org/dynamic/stories/U/US_SHRINKING_SCHOOL_WEEK

FCC Finally Kills Off Fairness Doctrine

http://www.politico.com/news/stories/0811/61851.html

The content contained in the Hyper Report is provided for informational purposes only. Use the information found in these videos as a starting point for conducting your own research and before making any significant investing decisions. All stories are sourced and assumes all information to be truthful and reliable; however, I cannot and do not warrant or guarantee the accuracy of this information.

This video is protected by the Fair use Act-Title 17 Chapter 1, Article 107 pertaining to the use of copyrighted works to illustrate an opinion, or for educational purposes...

Thank you.

Gold Seeker Closing Report: Gold and Silver Gain Over 2% More - SilverSeek.com

Posted 22 August, 2011 |

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Yes, the price of silver is indeed looking bright and shiny!

Silver Price Looking Bright & Shiny!

"Most of the cost to ship silver and gold, about 80% of the cost, is for the insurance, to insure against the loss of theft of it. And here's how it breaks down, as follows:

To ship 100 oz. gold, requires 4 packages, because you can only insure so much at one time, not more than $25,000 worth. $45 each package.To compare, it costs $20 to ship 100 oz. silver; $8 for the one box, and $12 for the insurance. Insurance is much less, due to the lower value.

Total cost to ship 100 oz. of gold = $45 x 4 = $180

Gold is 9 times as expensive as silver to ship, on an ounce per ounce basis at current prices, and more inconvenient, due to having to break down the packaging into 4 boxes."

http://silverprice.org/silver-price-news/2008/01/silver-price-looking-bright-shiny.html

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

August 22, 2011 Midday Metals Report

Gold Rallies as Money Flees - By Aaron Task | Daily Ticker

Gold Rallies as Money Flees “Leveraged Financial System,” Dempsey Says

Mon, Aug 22, 2011, 9:36 PM EDT - U.S. Markets closedAll information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Stocks: Not Too Late To Sell

http://ciovaccocapital.com/wordpress/index.php/risk-reward/dip-buyers-beware-...

In the early stages of a bear market, it may feel like "it is too late to sell" or "too late to develop stop loss plans for my stocks and investments". However, using history as a guide, it may still be a good time to develop a bear market risk management plan for your investment portfolio. Chris Ciovacco, of Ciovacco Capital Management, reviews risk-reward ratios in the context of portfolio management.

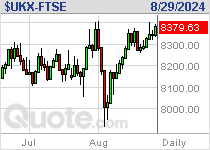

Aug 22 Market Charts

Market Charts

| ||

| ||

| ||

| ||

| ||

| ||

|

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Bank of America Tanks; Gold Goes Parabolic, No Telling Where It Stops

I am somewhat amused by the lack of commentary on the latest advance in gold. Did people sell, waiting for a correction that did not come? I do not know the answer to that, but I can see that financials have been clobbered, led by Bank of America, while gold has soared. These events are not unrelated.

Bank of America Daily

Bank of America Weekly

Questions Abound

- Who would have believed in 2007 that a 44 cent drop in share price would amount to a 6.3% move?

- How long before Bank of America tests that spike low of $2.51?

- How much is CEO Brian Moynihan worth?

This is no longer an orderly-looking move, but a weekly chart can help maintain perspective.

Gold Weekly Chart

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.