Thursday 28 April 2011

650 Year Silver Inflated Chart and Analysis

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Market cap greater than $10 billion

April 28 2011

Here are the top stocks, with a market cap greater than $10 billion, that hit 52-week highs in today’s trading:

- Coach Inc. (NYSE:COH): Up 1.54% to $58.13. Coach, Inc.designs, produces, and markets primarily leather goods. The Company’s products include handbags, business cases, men’s and women’s accessories, luggage and travel accessories, leather outerwear, and gloves. Coach, together with a licensing partner, offers watches, footwear, furniture, and eyewear. Coach Earnings: 50% Increase in the Dividend>>

- HJ Heinz Co. (NYSE:HNZ): Up 0.43% to $51.23. H.J. Heinz Company manufactures and markets processed food products throughout the world. The Company’s principal products include ketchup, condiments and sauces, frozen food, soups, beans and pasta meals, infant nutrition and other processed food products.

- Luxottica Group SpA (NYSE:LUX): Up 1.27% to $34.40. Luxottica Group S.p.A. and its subsidiaries design, manufacture, distribute, and market traditional and designer eyeglass frames and sunglasses. The Company’s LensCrafter retail chain of optical stores operates in North America. Luxottica distributes its products around the world. The Company also sells sunglasses through its Sunglass Hut retail chain.

- General Growth Properties Inc. (NYSE:GGP): Up 2.25% to $16.35. General Growth Properties, Inc. is a real estate investment trust (REIT). The Company owns, operates, leases, acquires and expands enclosed regional shopping mall centers throughout the United States. The REIT, with its operating partnership also has unconsolidated equity interests in other regional mall companies.

- Pearson plc (NYSE:PSO): Up 2.86% to $19.40. Pearson plc is a holding company, whose international subsidiaries operate in the education and media sectors. The Company publishes various financial papers, trade books, textbooks and electronic education programs, via their businesses which include the Financial Times, Penguin, and The Economist.

- Cardinal Health, Inc. (NYSE:CAH): Up 2.01% to $44.11. Cardinal Health, Inc. provides complementary products and services to healthcare providers and manufacturers. The Company’s services include pharmaceutical distribution, health-care product manufacturing, distribution and consulting services, drug delivery systems development, pharmaceutical packaging, automated dispensing systems manufacturing, and retail pharmacy franchising.

- Aetna Inc. (NYSE:AET): Up 0.3% to $39.81. Aetna Inc. is a diversified health care benefits company that provides healthcare and related benefits, serving health care members, dental members, and group insurance customers. The Company offers medical, pharmacy, dental, behavioral health, group life and disability plans, and medical management capabilities and health care management services for Medicaid plans.

- Altera Corp. (NASDAQ:ALTR): Up 4.1% to $48.50. Altera Corporation designs, manufactures, and markets programmable logic devices and associated development tools. The Company’s products, include a variety of programmable logic devices and hardcopy application-specific integrated circuits.

- Consolidated Edison Inc. (NYSE:ED): Up 0.94% to $51.56. Consolidated Edison, Inc., through its subsidiaries, provides a variety of energy related products and services. The Company supplies electric service in New York, parts of New Jersey, and Pennsylvania as well as supplies electricity to wholesale customers.

- Lorillard, Inc. (NYSE:LO): Up 0.49% to $104.24. Lorillard, Inc. manufactures and sells cigarettes. The Company produces cigarettes for both the premium and discount segments of the domestic cigarette market for sale to distributors and retailers in the United States. Lorillard Earnings: Shareholders Light One Up>>

- Symantec Corporation (NASDAQ:SYMC): Up 2.02% to $19.73. Symantec Corporation provides security, storage and systems management solutions to help businesses and consumers secure and manage their information. The Company offers software and services that protect, manage and control information risks related to security, data protection, storage, compliance and management.

- El Paso Corp. (NYSE:EP): Up 0.36% to $19.32. El Paso Corporation operates natural gas pipeline and storage facilities, transports natural gas, and imports liquefied natural gas. El Paso also explores for and produces natural gas. The Company has operations in the United States, Brazil, and Egypt.

- Alcatel-Lucent (NYSE:ALU): Up 3.01% to $6.51. Alcatel-Lucent manufactures telecommunications equipment, and offers telecommunications services. The Company’s telecommunications equipment and services enable its customers to send or receive virtually any type of voice or data transmission. Alcatel-Lucent designs and builds public and private networks, communications systems and software, and data networking systems.

- Boston Properties Inc. (NYSE:BXP): Up 0.93% to $101.89. Boston Properties, Inc. is a real estate investment trust. The trust owns, manages, and develops office properties in the United States, with a significant presence in Boston, Washington, D.C., Midtown Manhattan and San Francisco.

- Bed Bath & Beyond, Inc. (NASDAQ:BBBY): Up 0.21% to $57.25. Bed Bath & Beyond Inc. operates a nationwide chain of retail stores. The Company, through its retail stores, sells a wide assortment of merchandise principally including domestics merchandise and home furnishings as well as food, giftware, health and beauty care items and infant and toddler merchandise.

- Annaly Capital Management, Inc. (NYSE:NLY): Up 0.45% to $17.79. Annaly Capital Management Inc. is a real estate investment trust which owns and manages assets and funds on behalf of institutional and individual investors worldwide. The Company manages a portfolio of mortgage backed securities, including mortgage pass through certificates, collaterized mortgage obligations, and other securities.

- iShares Silver Trust (NYSE:SLV): Up 6.75% to $47.00. iShares Silver Trust is a trust formed to invest in silver. The assets of the trust consist primarily of silver held by the custodian on behalf of the trust. The objective of the trust is for the shares to reflect the price of silver owned by the trust, less the trust’s expenses and liabilities. Silver Technical Trade Targets You Must Know in Today’s Market>>

- Progress Energy Inc. (NYSE:PGN): Up 0.21% to $46.95. Progress Energy, Inc. is an integrated electric utility that provides energy and energy-related products and services in the Southeast United States. The Company serves electric and gas customers in the Carolinas and in Florida.

- PPL Corporation (NYSE:PPL): Up 0.88% to $27.37. PPL Corporation is an energy and utility holding company. The Company, through its subsidiaries, generates electricity from power plants in the northeastern and western United States, and markets wholesale and retail energy primarily in the northeastern and western portions of the United States, and delivers electricity in Pennsylvania and the United Kingdom.

- Sempra Energy (NYSE:SRE): Up 1.05% to $54.89. Sempra Energy is an energy services holding company with operations throughout the United States, Mexico, and other countries in South America. The Company, through its subsidiaries, generates electricity, delivers natural gas, operates natural gas pipelines and storage facilities, and operates a wind power generation project.

- Check Point Software Technologies Ltd. (NASDAQ:CHKP): Up 1.23% to $54.26. Check Point Software Technologies Ltd. develops, markets and supports a range of software and hardware products and services for information technology (NYSE:IT) security and offers its customers a network and gateway security solutions, data and endpoint security solutions and management solutions.

- Limited Brands, Inc. (NYSE:LTD): Up 0.88% to $41.14. Limited Brands, Inc. owns and operates specialty stores throughout the United States. The Company, through its retail stores, offer a wide range of products, including women’s apparel, women’s lingerie, beauty products and accessories, personal care, and home fragrance products. The Company’s stores also offer products via the Internet.

- Edison International (NYSE:EIX): Up 1.11% to $39.20. Edison International, through its subsidiaries, develops, acquires, owns, and operates electric power generation facilities worldwide. The Company also provides capital and financial services for energy and infrastructure projects, as well as manages and sells real estate projects. Additionally, Edison provides integrated energy services, utility outsourcing, and consumer products.

- CIGNA Corporation (NYSE:CI): Up 0.92% to $45.92. CIGNA Corporation, through its subsidiaries, provides group life and health insurance, managed care products and services, retirement products and services, and individual financial services worldwide. The Company also sells individual life and health insurance and annuity products in selected international locations.

- Ecolab Inc. (NYSE:ECL): Up 1.97% to $52.75. Ecolab Inc. develops and markets products and services for the hospitality, institutional, and industrial markets. The Company provides cleaning, sanitizing, pest elimination, and maintenance products, systems, and services. Ecolab provides its services to hotels and restaurants, healthcare and educational facilities, light industry, and other customers located worldwide. Ecolab Inc Earnings Cheat Sheet: Spring Cleaning is Here>>

- Millicom International Cellular SA (NASDAQ:MICC): Up 1.53% to $108.60. Millicom International Cellular S.A. develops and operates cellular telephone systems worldwide. The Company has interests in cellular systems primarily in emerging markets in Asia, Latin America, Europe, and Africa.

- V.F. Corporation (NYSE:VFC): Up 2.38% to $107.51. VF Corporation is an international apparel company. The Company owns a broad portfolio of brands in the jeanswear, outerwear, packs, footwear, sportswear and occupational apparel categories. VF Corp’s products are marketed to consumers shopping in specialty stores, upscale and traditional department stores, national chains and mass merchants.

- AmerisourceBergen Corporation (NYSE:ABC): Up 2.31% to $42.03. AmerisourceBergen Corporation is a pharmaceutical services company. The Company distributes pharmaceutical products and services. AmerisourceBergen distributes an offering of brand name and generic pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, and related services to a variety of healthcare providers.

- Bunge Limited (NYSE:BG): Down 0.88% to $74.34. Bunge Limited is an integrated global agribusiness and food company spanning the farm-to-consumer food chain. The Company processes soybeans, produces and supplies fertilizer, manufactures edible oils and shortenings, mills dry corn and wheat, manufactures isolated soybean protein, and produces other food products. Bunge has primary operations in North and South America.

- Mylan, Inc. (NASDAQ:MYL): Up 0.12% to $25.23. Mylan Inc. is a global generic and specialty pharmaceuticals company. The Company operates an active pharmaceutical ingredient manufacturer and runs a specialty business focused on respiratory, allergy, and psychiatric therapies.

- Avalonbay Communities Inc. (NYSE:AVB): Up 0.63% to $126.63. AvalonBay Communities, Inc. is a self-managed, fully-integrated multi-family real estate investment trust. The Company focuses on the ownership and operation of institutional-quality apartment communities in high barrier-to-entry markets of the United States. The markets are located in Northern and South California and in the Mid-Atlantic, Northeast, Midwest and Pacific Northwest region. AvalonBay Communities Earnings: Net Income Sinks>>

- Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX): Up 4.95% to $55.54. Vertex Pharmaceuticals Incorporated discovers, develops, and commercializes novel, small molecule pharmaceuticals for the treatment of diseases for which there are currently limited or no effective treatments. The Company is developing drugs for the treatment of viral diseases, multidrug resistance in cancer, inflammatory and autoimmune diseases, and neurodegenerative diseases.

- W.W. Grainger, Inc. (NYSE:GWW): Up 0.79% to $150.19. W.W. Grainger, Inc. distributes maintenance, repair and operating supplies, and related information to the commercial, industrial, contractor, and institutional markets in North America. The Company’s products include motors, HVAC equipment, lighting, hand and power tools, pumps, and electrical equipment. W.W. Grainger Earnings: A Stock Up Big in a Down Market>>

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Gold Morning - 28 April ..24 Hour Spot

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif)

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Silver Morning...24 Hour Spot

![Live 24 hours silver chart [ Kitco Inc. ]](http://www.kitco.com/images/live/silver.gif)

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

The Dollar Meltdown - book

The Dollar Meltdown: Surviving the Impending Currency Crisis with Gold, Oil, and Other Unconventional Investments

The Dollar Meltdown: Surviving the Impending Currency Crisis with Gold, Oil, and Other Unconventional InvestmentsAs a reader of The International Forecaster you already know the U.S. Dollar is in trouble. In fact irresponsible politicians, dependence on foreign creditors, metastasizing debt, and the Federal Reserve’s monetary malpractice guarantee a dollar calamity! I want you to read THE DOLLAR MELTDOWN, a brand new book by my friend Charles Goyette.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Bob Chapman on discount gold silver trading 27 Apr 2011

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Judge Charlie Gasparino on the Fed

click here...

http://finance.yahoo.com/video/managingandleadership-19142760/charlie-gasparino-on-the-fed-25048054

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

http://finance.yahoo.com/video/managingandleadership-19142760/charlie-gasparino-on-the-fed-25048054

Charlie Gasparino on the Fed

2 hours ago - FOXBusiness 7:01 | 71 views

FBN?s Charlie Gasparino joins the Judge to break down the significance of Fed Chair Ben Bernanke?s unprecedented press conference and the Judge tells him he sounds like he?s been watching a lot of Freedom Watch.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Trading Floor

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Albert Einstein - The Economist

When Albert Einstein died, he met three New Zealanders in the queue outside the Pearly Gates. To pass the time, he asked what were their IQs. The first replied 190. "Wonderful," exclaimed Einstein. "We can discuss the contribution made by Ernest Rutherford to atomic physics and my theory of general relativity". The second answered 150. "Good," said Einstein. "I look forward to discussing the role of New Zealand's nuclear-free legislation in the quest for world peace". The third New Zealander mumbled 50. Einstein paused, and then asked, "So what is your forecast for the budget deficit next year?" —The Economist, June 13th 1992, p. 71).

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Silver Rush

Silver Rush Spreads to Stock Market

by Tom Lauricella and Carolyn Cui

Wednesday, April 27, 2011

Wednesday, April 27, 2011

The mania for silver has spread to the stock market as day traders pile into the buying.

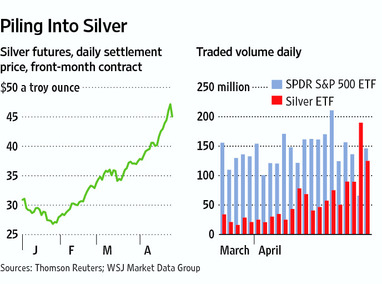

Trading got so heated during the past two days that shares traded in the iShares Silver Trust, the biggest exchange-traded fund tracking the price of silver, topped that of the SPDR S&P 500 ETF, usually one of the most actively traded securities in the world.

Day traders "are going crazy," says Joseph Saluzzi, co-head of trading at brokerage firm Themis Trading. "It's typical of the bubbly speculation that's been going on in silver."

On Monday, trading in the silver ETF was especially heavy, as silver prices soared to new 31-year highs and approached $50 an ounce. Silver is up 46% this year, part of a nine-month rally. The heavy ETF trading continued on Tuesday, as silver prices retreated.

[More from WSJ.com: Shiller vs. Siegel: Are Stocks Cheap or Dear]

Volume in the silver ETF on Monday reached a record 189 million shares, compared with an unusually low 65 million for the SPDR. The trading in the silver ETF was five times that of the 37 million daily average of the first quarter and blew past its previous daily peak of 149 million shares set in early November. On Tuesday, the silver ETF's trading was 125 million shares, falling just 21 million short of the SPDR volume.

The volume in silver ETFs is remarkable because the ETF until recently was relatively small and was shunned by mainstream traders. Its ascent reflects a surge in appetite for silver, which itself is reflecting a rise in the price of gold.

Investors have turned to precious metals amid worries about inflation and the weakness in the U.S. dollar. The metals are increasingly considered attractive as a permanent store of value that doesn't diminish like paper currencies.

Trading volume of silver futures contracts on the commodities exchange owned by CME Group rose to 319,205 contracts on Monday, a 58.6% jump from its prior record hit in November. Month to date, the contract's average daily volume has more than tripled compared with the same period last year. Total outstanding contracts in the silver-options market also reached a record on Monday.

[More from WSJ.com: A Guide to Fed Chairman's First Q&A ]

The heavy trading interest came as silver closes in on its record price of $48.70. Silver touched an intraday high of $49.105 per ounce on Monday before settling at $47.1510, a 31-year high. It dropped 4.4% to $45.0580 on Tuesday.

In some respects, the surge in silver ETF volume above the SPDR was made easier by relatively lack of volume in the SPDR fund.

Many investors have been sitting on the sidelines ahead of a crucial Federal Reserve meeting Wednesday. Trading also was muted Monday by a holiday across most of Europe.

The evidence of day-traders flocking to silver can be seen in the surge of trading in high-octane ETFs designed to magnify the moves in silver prices up or down. Trading in ProShares UltraShort Silver, an ETF that offers a levered bet on falling silver prices, totaled more than nearly eight times its average daily volume over the last three months. The fund is down more than 40% in 2011.

Scott Redler, chief strategic officer at T3 Trading Group, says day traders started to buy into silver ETF trading when silver prices first broke higher two weeks ago.

[More from WSJ.com: Computers, Too, Can Give Away Location]

"When that happened, momentum traders put it on their radar," Mr. Redler said.

It hasn't been one-way bet, however. Mr. Redler was among those last week selling borrowed shares of the iShares ETF in anticipation of buying them back at a lower prices later and pocketing the difference.

But, he says, so many traders were looking to do the same trade that, starting last Wednesday, "it was really tough" to locate shares to borrow.

"You had to 'get on line,"' for the shares, he says.

Part of the most recent surge in silver prices was the result of those bearish traders scrambling to buy in order to cover short positions.

On Monday, "we saw a lot of the shorts capitulate," Mr. Redler says.

Write to Tom Lauricella at tom.lauricella@wsj.com and Carolyn Cui at carolyn.cui@wsj.com

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Gold Takes Off....Again! Thank You Bernanke!

Will Gold catch up to Silver's stellar run? Mark Gordon takes a quick look at gold.

More info at www.goldenticker.com -

Free Live charts at http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2670890

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Silver's versatility

Silver's versatility to help sustain rally

Singapore 27 April 2011

Silver's near record high has done little to deter investors' interest in the metal, while demand from the industrial sector should ensure the rally isn't a temporary phenomenon. A rush to buy physical silver this week, as prices came within cents of a record fix of $49.48 an ounce seen in 1980, shows that the metal's bright outlook could offset fears about a possible surplus this year.

With industrial use rising and investment demand showing no signs of slowing down, silver may avoid a repeat of a brutal correction in the 1980s that happened not long after the Hunt brothers tried to corner the market. A lack of substitutes means the industrial sector has to rely on the metal, prices of which have risen more than 60 percent this year after a gain of more than 80 percent in 2010. Gold, which often sets the tone for silver prices, has only gained around 8 percent to a record above $1,518 an ounce.

"Silver has always had quite a big chunk of demand which is price-insensitive in the short to medium term," said Philip Klapwijk, executive chairman of metals research and consultancy GFMS, which is expecting industrial demand for silver to hit a record this year.

"It is a net clear winner from new technology in the last 10 to 15 years. It obviously lost ground in photography, but more than made it up in industrial uses," he told Reuters. A versatile metal, silver is used in jewellery, water purification, photography as well as solar panels, flat-screen television sets, computers and mobile phones.

Although investment has played a key role in pushing prices to the current levels, silver is also riding high on growing demand from the industrial sector, which accounts for more than half of global silver fabrication demand.

Industrial applications demand rose over 20 percent yearon- year to 487.4 million ounces in 2010 after a miserable performance in 2009, when the global manufacturing sector suffered from the worst economic crisis since the Great Depression, according to GFMS. This year the consultancy expects industrial demand to rise by 8 percent.

As investors pour money into silver on uncertainty in the global economy, holdings in the iShares Silver Trust, the world's largest silver-backed exchange-traded fund, rose to a lifetime high of 11,390.06 tonnes by April 25.

"While silver may face resistance at its 1980 peak in the short term, it could eventually head above $50 if gold holds firm," said Ong Yi Ling, investment analyst at Phillip Futures in Singapore.

Silver traded around $46 an ounce on Tuesday as speculators booked profits after sending prices to a 31-year peak at $49.31 in the previous session.

Premiums for silver bars were steady at $1 an ounce over spot London prices in Hong Kong and at 50 cents in Singapore, with dealers noting steady purchases from India, the Middle East and China, the world's second-largest silver consumer after the United States.

"This is different from what happened in 1980s. The whole world is buying, it's not only one or two guys buying," said Ronald Leung, director of Lee Cheong Gold Dealers in Hong Kong.

The Hunt brothers, two Texan oil tycoons, bet their family fortune trying to corner the silver market between September 1979 and March 1980, driving U.S. silver futures to a record high $50.35 an ounce in January 1980. When their attempt collapsed silver prices fell back to below $11 by the end of March.

India, the world largest gold consumer, has also seen a surge in silver demand as an alternative investment to bullion, leading to tightness in the physical market.

"Investors have found a new fascination for silver other than as an asset. I may have sold 5 tonnes in 2-4 days," said Pankaj Kumar Agarwal, director of wholesaler Brijwasi Bullion and Jewellers Ltd, which supplies the metal to India's northern states of Uttar Pradesh and Bihar, and usually sells 4 to 5 tonnes a month.

"Silver sales have been quick and fast compared to gold." A dearth of supplies in the physical market in India is keeping premiums steady at 40 cents an ounce.

Fundamentals could help the metal resist pressure from mine supply, which rose 2.5 percent to 22,889 tonnes in 2010 -- a record high.

"If you look at the traditional fundamentals, the silver market is absolutely awful. We estimate the surplus equivalent to a fifth of the market, at about 5,000 tonnes in the past a couple of years," said Giles Lloyd, a metals analyst at CRU. "But investment demand is clearly greater than that. The surplus is not big enough for investors to hoard and prices are going up."

Implied net investment, which includes silver exchange traded funds, jumped to 178 million ounces (5,536 tonnes) in 2010 from 120.7 ounces in 2009, according to GFMS.

Ends --

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Subscribe to:

Posts (Atom)