Thursday, 7 April 2011

Jim Rogers `Short' Emerging Market, Nasdaq Stocks March 2011

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Steve Nison's Highlights Newsletter: Hammers and Trend

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Jesse Ventura: Enough Government Cover-ups! It's time for a Revolution!

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Weekly forecast and outlook for financial market 28/3-1/4 | Trading Energy

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Gold & Silver Prices Outlook –6 April

China raised its interest rate

Bank of China raise its basic interest rate by 25 basis points to 6.31%. This is the second interest rate raise this year. This decision was taken to slow down China’s growing inflation, which as of February 2011 reached 4.9% annual rate.

China is the second largest consumer of gold after India: according to the Gold council recent report pertaining fourth quarter 2010, China’s jewellery demand reached a new annual record of 400 tons, and its annual demand for bars and coins totaled 179.9 tons – an increase of 70% (Y-2-Y).

The recent rise in interest rate might adversely affect its demand for precious metals, such as gold and silver. If it will have such an affect, it will be felt in the upcoming months.

Turmoil in Middle East – update

The fights between the rebels and Gaddafi’s army progresses and even with NATO’s intervention the fights don’t subside.

This turmoil raises the instability in the Middle East and adversely affects the market of commodities and precious metals.

See here for more news and updates about the turmoil in the Middle East and its affect on commodities’ markets.

Gold and silver prices April 2011

The month of April started off with rises for gold and silver prices. During March silver prices rose by over 10% while gold prices didn’t do much.

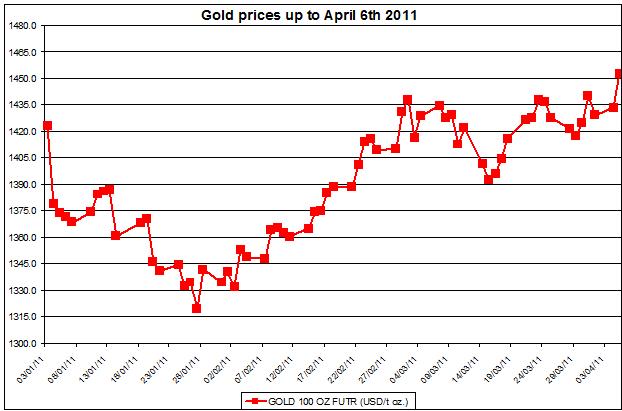

In the chart below are the changes of gold prices during 2011; the chart shows that gold pricesbounced back from its decline during January.

The gold to silver ratio: as of yesterday, April 5th the ratio between gold and silver pricesdeclined to 37.07 – the lowest level this month so far.

As seen in the graph below, the ratio of gold to silver prices continue to drop as silver pricesincrease by a higher rate than gold prices do

http://www.tradingnrg.com/gold-prices-forecast-silver-prices-outlook-april-6/

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Current crude oil prices moderately rise – April 6 | Trading Energy

Oil prices moderately rise – April 6

Yesterday, crude oil prices (WTI and Brent oil) moderately inclined; gold and silver prices continue their rally; natural gas spot price (Henry Hub) continues to zigzag as it declined yesterday.

Here is a short summary of the price changes in major energy commodities and precious metals for April 6th:

Oil and Gas prices:

Crude oil price (WTI spot) moderately inclined yesterday by 0.45% and reached 108.83$/b.

Brent spot price also rose by 0.47% to reach 121.93$/b.

As a result, the difference between Brent and WTI rose and reached at 13.10$/b.

Natural gas spot price (Henry Hub) continues to zigzag and declined yesterday by a 0.95% to reach 4.18$/mmbtu.

The Henry Hub future price, continue to decline by 1.89% to reach 4.15$/mmbtu, resulting in the spread between future and spot price reaching to -0.03$/mmbtu, i.e. backwardation.

Precious Metals prices:

Gold prices inclined by 0.41% and reached 1,458$; silver prices also inclined by 0.52% and reached 39.39$. During April, gold prices increased by 2.1%, and silver prices by 4.4%.

EURO/ USD moderately increased as the USD depreciated yesterday by 0.7%. For a more detailed report on major currencies, check out Forex crunch.

A summary of yesterday’s Prices Changes:

The table below includes: closing prices, daily percent change, and change in US dollars (except for USD/CAD, in which the change is in Canadian dollars):

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

10 2011 Strategy Calendar.

http://as.wiley.com/WileyCDA/WileyTitle/productCd-0470557443,descCd-tableOfContents.html

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Crude oil tends to continue its rally through April

Every spring I begin to get a little nervous about the stock market as my market seasonality clock starts thumping as the end of the Best Six Months (November-April) is nigh. This anxiety builds when the calendar rolls into April. If the market has been on binge as it has this year, as well as the last seven months – and the last two years for that matter this feeling of vertigo intensifies.

The recent exuberant sentiment readings from the venerable Investors Intelligence service are adding to my feelings of apprehension. In their Advisors Sentiment note this morning Mike Burke and John Gray observed that:

"The bulls moved up to 57.3% from 51.6% last week and their recent low at 50.6% just prior to that. The new increase in bullishness is not a good sign as it signals more funds moving off the sidelines and into stocks. This is the most bulls since mid-December when we counted 58.8%. At the end of last August’s market lows the bulls were as few as 29.4%, suggesting a time to buy. The latest reading suggests increased danger. At the October 2007 top the bulls were 62.0%.

"After a 7.4% drop the bears were down to 15.7%. They were 23.1% a week ago. The current negative reading below 20% is a low since mid-December 2009 when they were 15.6%. Low levels for the bears say there is not much cash left on the sidelines.

"The remaining advisors, classified as correction, rose to 27.0% from 25.3% last week. That category has been in a tight 5% range for the past 8-weeks, at fairly high levels. Some nervous bulls have shifted back and forth into this camp, avoiding outright negative projections.

"The difference between the bulls and bears jumped to +41.6%, a negative level. Last week it was +28.5% and contracting in the right direction for more stock gains. This latest reading is close to the +42.4% spread that accompanied the all-time market peak from October 2007. This is bearish."

We remain vigilant for our Seasonal Sell Signal and on increasingly high alert for a deeper correction.

http://blog.stocktradersalmanac.com/post/Frothy-Sentiment

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Crude oil tends to continue its rally through April

Every spring I begin to get a little nervous about the stock market as my market seasonality clock starts thumping as the end of the Best Six Months (November-April) is nigh. This anxiety builds when the calendar rolls into April. If the market has been on binge as it has this year, as well as the last seven months – and the last two years for that matter this feeling of vertigo intensifies.

The recent exuberant sentiment readings from the venerable Investors Intelligence service are adding to my feelings of apprehension. In their Advisors Sentiment note this morning Mike Burke and John Gray observed that:

"The bulls moved up to 57.3% from 51.6% last week and their recent low at 50.6% just prior to that. The new increase in bullishness is not a good sign as it signals more funds moving off the sidelines and into stocks. This is the most bulls since mid-December when we counted 58.8%. At the end of last August’s market lows the bulls were as few as 29.4%, suggesting a time to buy. The latest reading suggests increased danger. At the October 2007 top the bulls were 62.0%.

"After a 7.4% drop the bears were down to 15.7%. They were 23.1% a week ago. The current negative reading below 20% is a low since mid-December 2009 when they were 15.6%. Low levels for the bears say there is not much cash left on the sidelines.

"The remaining advisors, classified as correction, rose to 27.0% from 25.3% last week. That category has been in a tight 5% range for the past 8-weeks, at fairly high levels. Some nervous bulls have shifted back and forth into this camp, avoiding outright negative projections.

"The difference between the bulls and bears jumped to +41.6%, a negative level. Last week it was +28.5% and contracting in the right direction for more stock gains. This latest reading is close to the +42.4% spread that accompanied the all-time market peak from October 2007. This is bearish."

We remain vigilant for our Seasonal Sell Signal and on increasingly high alert for a deeper correction.

http://blog.stocktradersalmanac.com/post/Frothy-Sentiment

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Crude oil tends to continue its rally through April

Every spring I begin to get a little nervous about the stock market as my market seasonality clock starts thumping as the end of the Best Six Months (November-April) is nigh. This anxiety builds when the calendar rolls into April. If the market has been on binge as it has this year, as well as the last seven months – and the last two years for that matter this feeling of vertigo intensifies.

The recent exuberant sentiment readings from the venerable Investors Intelligence service are adding to my feelings of apprehension. In their Advisors Sentiment note this morning Mike Burke and John Gray observed that:

"The bulls moved up to 57.3% from 51.6% last week and their recent low at 50.6% just prior to that. The new increase in bullishness is not a good sign as it signals more funds moving off the sidelines and into stocks. This is the most bulls since mid-December when we counted 58.8%. At the end of last August’s market lows the bulls were as few as 29.4%, suggesting a time to buy. The latest reading suggests increased danger. At the October 2007 top the bulls were 62.0%.

"After a 7.4% drop the bears were down to 15.7%. They were 23.1% a week ago. The current negative reading below 20% is a low since mid-December 2009 when they were 15.6%. Low levels for the bears say there is not much cash left on the sidelines.

"The remaining advisors, classified as correction, rose to 27.0% from 25.3% last week. That category has been in a tight 5% range for the past 8-weeks, at fairly high levels. Some nervous bulls have shifted back and forth into this camp, avoiding outright negative projections.

"The difference between the bulls and bears jumped to +41.6%, a negative level. Last week it was +28.5% and contracting in the right direction for more stock gains. This latest reading is close to the +42.4% spread that accompanied the all-time market peak from October 2007. This is bearish."

We remain vigilant for our Seasonal Sell Signal and on increasingly high alert for a deeper correction.

http://blog.stocktradersalmanac.com/post/Frothy-Sentiment

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Stock Trader's Almanac Blog

April is the Best Month for the Dow, Average 2.0% Gain Since 1950, 3rd Best Month for S&P, 4th Best for NASDAQ (Since 1971)

Dow: 52.4% S&P: 61.9% NAS: 71.4% R1K: 66.7% R2K: 52.4%—Tom Peters (referring to projects, Reinventing Work, 1999)

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

How Peter Lynch Destroyed the Market

By Anand Chokkavelu, CFA | More Articles

Seems elementary, right? But as someone who talks to lots of investors, I can report that you'd be shocked at how few investors actually do their research. Scroll down to No. 7 for a good first step in getting ahead of the game.

After 2008's crash, I noticed a distinct increase in armchair economists. We financial types do enjoy water cooler talk about interest rates, trade deficits, debt levels, etc. But there's a danger in converting thought into action.

Lynch mentions that Wal-Mart (NYSE: WMT ) was a 10-bagger -- i.e. its stock rose to 10 times its initial price -- 10 years after it went public. Even if you had gotten in after waiting a decade, though, you'd be sitting on a 100-bagger.

Lynch claims he was 0-for-25 in investing in companies that had no revenue but a great story. Remember, the guy who averaged 29% returns went oh-fer on long shots. You and I are unlikely to do much better.

The pithier Lynchism is: "Go for a business that any idiot can run – because sooner or later, any idiot is probably going to run it."

Lynch has said: "In this business, if you're good, you're right six times out of 10. You're never going to be right nine times out of 10."

Specifically, you should be able to explain your thesis in three sentences or less. And in terms an 11-year-old could understand. Once this simply stated thesis starts breaking down, it's time to sell.

Lynch noted that investors made a killing in the 1950s despite the very new threat of nuclear war. There are plenty of fears to choose from right now, but we've survived a Great Depression, two world wars, an oil crisis, and double-digit inflation.

So there you have it. These are the eight principles Peter Lynch used to bring the market to its knees. They seem simple, but trust me, sticking to them is harder than it sounds.

http://www.fool.com/investing/general/2010/05/21/how-peter-lynch-destroyed-the-market.aspx

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.