Thursday, 20 October 2011

JIM ROGERS CNBC Interview October 10th 2011

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

40 Trillion & Ticking: Global Debt Clock

KR on FB: http://www.facebook.com/KeiserReport

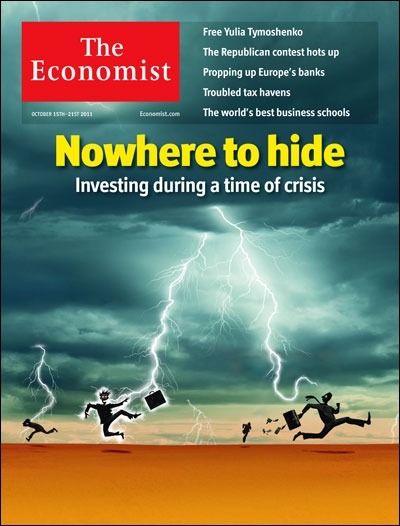

Nowhere to hide - cover....www.economist.com

This week’s cover: investors have had a dreadful time in the recent past. The immediate future looks pretty rotten, too. Oct 15th 2011

http://www.economist.com/node/21532286

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Crackdown on Commodity Trading....finance.yahoo.com/blogs/breakout

Crackdown on Commodity Trading: A Good Idea Spoiled

Wed, Oct 19, 2011Related Quotes:

- CR-Y.NYB

- 310.79

- +0.00 (+0.00%)

- CLX11.NYM

- 85.970001

- -0.14 (-0.16%)

- GCV11.CMX

- 1,626.10

- -19.90 (-1.21%)

- HGV11.CMX

- 3.19

- -0.06 (-1.97%)

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

How to silence a Nobel Prize winning economist: Ask him about the economy.

by SchiffReport on Oct 16, 2011

The Peter Schiff Show (10/14/2011)

Follow me on Twitter @SchiffRadio

Gold Prices on Hold by US Dollar | Annuity News Journal

By Christi Roberts on October 19, 2011 at 3:23 pm

As the aftermath of multiple bank stimuli continue to work their way through the financial system, gold prices continue to rise to unprecedented heights in anticipation of massive inflation. The Federal Reserve is widely seen as artificially holding down inflation to prevent commodity prices from going up in a time of recession, and gold has historically been seen as a hedge against a falling dollar. The dollar seems primed to fall when the Federal Reserve lets up on its “quantitative easing” program, according to most financial experts.

As gold prices continue to increase to record highs, many financial experts are recommending that their clients get into annuities, especially annuities that have a basket of recession proof commodities and stocks like gold.

In times immediately following recessions, many investments that are usually seen as low risk actually increased in price faster historically than so-called growth investments. Annuities with gold are among these types of investments, and they are, as if history is repeating itself yet again, going up in price much faster than even some full equity investments, which are fluctuating with the volatile economic environment. ...........

http://www.annuitynewsjournal.com/gold-prices-on-hold-by-us-dollar/

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.