All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Tuesday 31 May 2011

Greece Will Default, But When?

Greece Will Default, But When?

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

IMF Grand Prix: Can BRICS break boss tradition?

May 30, 2011

The race to run the International Monetary Fund is not so much about who, but where the candidate comes from. Europe traditionally decides who gets the post - and the EU is already pushing its preferred choice, making it hard for others to get a look in. But the five leading emerging economies say it's time someone else had a go. Irina Galushko reports on how the BRICS countries of Brazil, Russia, India, China and South Africa are refusing to take 'no' for an answer.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Asia week ahead: India GDP, China PMI

http://www.marketwatch.com

Asia week ahead: India GDP, China PMI

India's January-March gross domestic product figures will be in the spotlight, as well as key reports on Chinese manufacturing and Japanese industrial output and employment data for April. MarketWatch's Lisa Twaronite in Tokyo looks at the week ahead.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Gold at three-week high on Greek woes

METALS STOCKS

May 30, 2011, 3:50 p.m. EDT

Gold at three-week high on Greek woes

Gold legal currency in Utah, with other states considering the move

By Virginia Harrison, MarketWatch

NEW YORK (MarketWatch) — Gold futures on Monday rose to a three-week high as ongoing concern about Greek sovereign debt heightened the safe-haven appeal of the metal.

Gold for August delivery GCQ11 +0.23% , the most-active contract, rose $2.50, or 0.2%, to $1,539.8 an ounce in electronic trade on the Comex division of the New York Mercantile Exchange.

Silver also moved higher, with the July contract SIN11 +1.17% rising 23 cents, or 0.6%, to $38.09.

In Athens, Greece’s government on Monday readied to unveil billions of euros worth of new spending cuts and tax hikes, to be unveiled in coming days, as public demonstrations against the new measures continued.

Late Sunday, the Financial Times reported European leaders are trying to negotiate a new bailout for Greece that would bring wider outside intervention in the country’s financials.

Last week, gold prices gained 1.8%, with buying supported by concerns about euro-zone debt levels and a weaker dollar, which can encourage investment in dollar-priced commodities such as metals.

G-8 throw weight behind Arab Spring

The Group of Eight major economic nations throw their weight behind the Arab Spring, intensifying the pressure on Libyan strongman Moammar Ghadhafi and pledging billions for fledgling democracies. Video courtesy of AFP.

U.S. floor trading was closed Monday for the Memorial Day holiday.

The dollar index DXY -0.50% , which measures the greenback against a basket of six other major currencies, stood at 74.954 versus 74.911 late Friday. Read more about currencies.

Virginia Harrison is a MarketWatch reporter based in SydneyFor More GoTo....

http://www.marketwatch.com/story/gold-futures-fall-but-silver-moves-higher-2011-05-29?siteid=yhoof

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Lies, damned lies and returns

Lies, damned lies and returns

Michael Nairne, Financial Post: Monday, May 30, 2011

Read it on Global News: Lies, damned lies and returns

Read it on Global News: Lies, damned lies and returns

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Michael Nairne, Financial Post: Monday, May 30, 2011

Read it on Global News: Lies, damned lies and returns

U.S. author and journalist Mark Twain popularized the saying about "lies, damned lies and statistics."

Read it on Global News: Lies, damned lies and returns

Read it on Global News: Lies, damned lies and returns

The saying popularized by Mark Twain, "lies, damned lies and statistics," might spring to mind when investors grapple with the reams of return numbers spewed out by funds, managers and the financial press. It's easy to understand why investors can be confused.

First, the industry standard — which is a time-weighted rate of return — is designed to measure a portfolio's compound rate of growth and is not sensitive to the timing of investor contributions or withdrawals. Although this allows performance comparisons between the managers, their peers and benchmarks, it also means that the actual returns earned by individual investors can vary, sometimes significantly, from a fund's or manager's reported returns. For example, an investor who routinely invests money in equity funds at market highs and then pulls back during lows will have a personal rate of return less than that reported by the funds.

Unfortunately, the propensity to "buy high and sell low" means investors, as a group, earn returns well below those of their fund investments. Morningstar found that from 2000 to 2009, U.S. mutual fund investors earned returns 1.5% per annum less than the funds themselves. Investors in highly volatile funds that are often subject to performance chasing typically have even greater shortfalls. So if you're unhappy with your performance, your own behaviour might be a factor.

Second, there is often a difference between the historic returns profiled by mutual funds and those of private investment managers. Fund returns are typically portrayed net of fees while the returns of private investment managers are normally quoted gross of fees. This is because the percentage fee charged by private managers varies with the dollar amount invested so there is no single percentage fee to net against returns. If you are comparing funds to private managers, you likely will need to adjust accordingly.

Even when you have a complete, net of fee return history, you still don't have a full picture. Funds and private investment managers report their returns before tax. No adjustment is made for returns that are fully taxed (such as interest) and those that are more tax efficient (such as capital gains, eligible dividends and unrealized capital appreciation).

Affluent individuals with non-registered investments need to know the tax efficiency of their funds and managers. Studies in Canada and the United States have found that the performance ranking of many managers will change when comparisons are made post-tax as opposed to pre-tax. Taxes in many instances can even exceed fees.

Another problem with returns is that they may not reflect the risks to which an investor is exposed. Returns for certain assets, countries, or sectors can be mouth-watering for years in a row before the inevitable painful plunge. Think of Japanese stocks in the '80s, large-cap growth stocks in the '90s and U.S. houses in the past decade.

Even when the risks are known, investors must determine whether adding a particular asset class or strategy to their portfolios will enhance its diversification. Certain strategies that are highly volatile when viewed in isolation can actually improve the risk-adjusted return potential of a portfolio. International small-cap stocks and managed futures are examples.

Finally, focusing excessively on historic returns is also a mistake. Academic research indicates that the price movement of individual stocks is largely unpredictable and that active manager performance is also not persistent.

Aaron Levenstein quipped, "Statistics are like bikinis. What they reveal is suggestive, but what they conceal is vital." While return statistics do not lie, you have to dig behind them to get a complete understanding of the impact of contribution and withdrawal timing as well as the fees, taxes, risks and diversification effect associated with the returns.

— Michael Nairne, CFP, RFP, CFA is the president of Tacita Capital Inc., a private family office and investment counselling firm in Toronto. tacitacapital.com

Read it on Global News: Lies, damned lies and returns

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Gold to hit $1750 and Silver $50 - $60 in the Short Term says Juerg Kiener | Gold and Silver Blog

Gold to hit $1750 and Silver $50 - $60 in the Short Term says Juerg Kiener | Gold and Silver Blog

Gold to Hit $1750 in the Short Term says Juerg Kiener and multiple thousands in the medium term 1215 and 1216 , by that time silver would be worth around $500 an ounce he added : Lack of trust in governments in the western world is moving more and more people into physical ownership of gold Juerg Kiener, managing director and chief investment office at Swiss Asia Capital told CNBC. He added gold would hit $1750 an ounce in the short term with silver hitting $60 an ounce and that gold could hit multiple thousands of dollars by 2016 with silver above $100.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Gold to Hit $1750 in the Short Term says Juerg Kiener and multiple thousands in the medium term 1215 and 1216 , by that time silver would be worth around $500 an ounce he added : Lack of trust in governments in the western world is moving more and more people into physical ownership of gold Juerg Kiener, managing director and chief investment office at Swiss Asia Capital told CNBC. He added gold would hit $1750 an ounce in the short term with silver hitting $60 an ounce and that gold could hit multiple thousands of dollars by 2016 with silver above $100.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

No cash to pay your debts? We'll take your gold, Greece!

May 30, 2011

Watch the full Keiser Report E151 on Tuesday. This week Max Keiser and co-host, Stacy Herbert, report on the oil traders puking on markets and the gold confiscators eyeing Greece, Portugal, Spain and Italy. In the second half of the show, Max talks to former chief forex trader for VISA, Jon Matonis of TheMonetaryFuture.blogspot.com, about Bitcoin, the new peer-to-peer crypto-currency.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Monday 30 May 2011

Recession in China could be a technical recession - THE MARC FABER BLOG

THE MARC FABER BLOG

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

SUNDAY, MAY 29, 2011

Recession in China could be a technical recession

Marc Faber : ..recession in China could be a technical recession , if you go and slow down from a growth rate of say ten percent to a growth rate of three percent then there is a recession , also I do not believe in the growth rate that China publishes , because if you had adjusted nominal GDP for the true rate of inflation then real growth is of course much slower , you know I want to tell you something that disturbs me in all emerging economies and in many other developed economies , from my taste in front of luxury hotels there are far too many Ferraries and Maseraties and Bentleys and this is not a good sign , you should see depression when conditions are depressed . I see a boom everywhere except for the working class and except for the lower middle class , but among the well-to-do people the wealth that is floating around and the prices you pay for high end properties is incredible and I think that will come to an end and a lot of people will lose a lot of money and so I am ultra careful at the present time ....." Marc Faber interviewed by Bloomberg TV May 25 2011

Related ETFs: SPDR GOld ETF (GLD), Powershares DB SPDR Gold ETF (GLD), Newmont Mining (NEM), Barrick Gold (ABX), GoldCorp (GG) Agriculture Fund (DBA), ProShares UltraShort 20+ Year Trea (ETF) (NYSE:TBT), iShares Barclays 20+ Yr Treas.Bond (ETF) (NYSE:TLT) United States Oil Fund (USO), SPDR Gold ETF (GLD), Powershares DB Agriculture ETF (DBA) SPDR S&P 500 ETF (NYSE:SPY), SPDR Dow Jones Industrial Average ETF (NYSE:DIA), iShares Russell 2000 Index (ETF) (NYSE:IWM), PowerShares QQQ Trust, Series 1 (ETF) (NASDAQ:QQQ)

Contrarian Investor Dr.Marc Faber is an international investor known for his uncanny predictions of the stock market and futures markets around the world.

Related ETFs: SPDR GOld ETF (GLD), Powershares DB SPDR Gold ETF (GLD), Newmont Mining (NEM), Barrick Gold (ABX), GoldCorp (GG) Agriculture Fund (DBA), ProShares UltraShort 20+ Year Trea (ETF) (NYSE:TBT), iShares Barclays 20+ Yr Treas.Bond (ETF) (NYSE:TLT) United States Oil Fund (USO), SPDR Gold ETF (GLD), Powershares DB Agriculture ETF (DBA) SPDR S&P 500 ETF (NYSE:SPY), SPDR Dow Jones Industrial Average ETF (NYSE:DIA), iShares Russell 2000 Index (ETF) (NYSE:IWM), PowerShares QQQ Trust, Series 1 (ETF) (NASDAQ:QQQ)

Contrarian Investor Dr.Marc Faber is an international investor known for his uncanny predictions of the stock market and futures markets around the world.

The Inflation in the US is ten percent

Marc Faber : "...we had a huge run in asset prices , from the lows in March 2009 until recently , I do not think they will continue to go up a lot , I rather think that QE2 will come to an end that we will have a correction and then we will have more money printing but it may not help the economy at all "

"...I think what will happen is that these deficits will stay very high and that they will lead to very high inflation rates most likely hyperinflation not tomorrow but over time , all I can say is I travel a lot and I am surprised that the US can publish a consumer price index of two percent when everything I see is up significantly in price not a little bit , significantly and so I think here the rate of inflation has to be closer between 5 and 10 percent ,in my opinion closer to ten percent than five percent ,and elsewhere I also see prices going up substantially and so the potential for high inflation is actually there ....."

in an interview with Bloomberg TV 25 May 2011

Related ETFs: SPDR GOld ETF (GLD), Powershares DB SPDR Gold ETF (GLD), Newmont Mining (NEM), Barrick Gold (ABX), GoldCorp (GG) Agriculture Fund (DBA), ProShares UltraShort 20+ Year Trea (ETF) (NYSE:TBT), iShares Barclays 20+ Yr Treas.Bond (ETF) (NYSE:TLT) United States Oil Fund (USO), SPDR Gold ETF (GLD), Powershares DB Agriculture ETF (DBA) SPDR S&P 500 ETF (NYSE:SPY), SPDR Dow Jones Industrial Average ETF (NYSE:DIA), iShares Russell 2000 Index (ETF) (NYSE:IWM), PowerShares QQQ Trust, Series 1 (ETF) (NASDAQ:QQQ)

Contrarian Investor Dr.Marc Faber is an international investor known for his uncanny predictions of the stock market and futures markets around the world.

"...I think what will happen is that these deficits will stay very high and that they will lead to very high inflation rates most likely hyperinflation not tomorrow but over time , all I can say is I travel a lot and I am surprised that the US can publish a consumer price index of two percent when everything I see is up significantly in price not a little bit , significantly and so I think here the rate of inflation has to be closer between 5 and 10 percent ,in my opinion closer to ten percent than five percent ,and elsewhere I also see prices going up substantially and so the potential for high inflation is actually there ....."

in an interview with Bloomberg TV 25 May 2011

Related ETFs: SPDR GOld ETF (GLD), Powershares DB SPDR Gold ETF (GLD), Newmont Mining (NEM), Barrick Gold (ABX), GoldCorp (GG) Agriculture Fund (DBA), ProShares UltraShort 20+ Year Trea (ETF) (NYSE:TBT), iShares Barclays 20+ Yr Treas.Bond (ETF) (NYSE:TLT) United States Oil Fund (USO), SPDR Gold ETF (GLD), Powershares DB Agriculture ETF (DBA) SPDR S&P 500 ETF (NYSE:SPY), SPDR Dow Jones Industrial Average ETF (NYSE:DIA), iShares Russell 2000 Index (ETF) (NYSE:IWM), PowerShares QQQ Trust, Series 1 (ETF) (NASDAQ:QQQ)

Contrarian Investor Dr.Marc Faber is an international investor known for his uncanny predictions of the stock market and futures markets around the world.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

110530 - Hyper Report

May 30, 2011

Hyper Report is sponsored by FutureMoneyTrends.com (http://futuremoneytrends.com/ )

Source Links for Today's Items:

The Door is About to Shut for Americans

http://www.dollarvigilante.com/blog/2011/5/26/the-door-is-about-to-shut-for-a...

U.S. Dollar Could Collapse

http://www.globalnews.ca/world/dollar+could+collapse/4839011/story.html

A Frightening Satellite Tour Of America's Foreclosure Wastelands

http://www.businessinsider.com/satellite-tour-foreclosure-wastelands-2011-5#i...

Shale Boom in Texas Could Increase U.S. Oil Output

http://www.nytimes.com/2011/05/28/business/energy-environment/28shale.html?_r=1

Forget the Spin. Taxpayers Still on the Hook for Auto Bailouts

http://washingtonexaminer.com/opinion/2011/05/forget-spin-taxpayers-still-hoo...

Extreme Paranoia

http://theeconomiccollapseblog.com/archives/extreme-paranoia

Please prepare now for the beginning of the economic and social unrest.

The content contained in the Hyper Report is provided for informational purposes only. Use the information found in these videos as a starting point for conducting your own research and before making any significant investing decisions. All stories are sourced and assumes all information to be truthful and reliable; however, I cannot and do not warrant or guarantee the accuracy of this

information.

This video is protected by the Fair use Act-Title 17 Chapter 1, Article 107 pertaining to the use of copyrighted works to illustrate

an opinion, or for educational purposes...

Thank you.

Source Links for Today's Items:

The Door is About to Shut for Americans

http://www.dollarvigilante.com/blog/2011/5/26/the-door-is-about-to-shut-for-a...

U.S. Dollar Could Collapse

http://www.globalnews.ca/world/dollar+could+collapse/4839011/story.html

A Frightening Satellite Tour Of America's Foreclosure Wastelands

http://www.businessinsider.com/satellite-tour-foreclosure-wastelands-2011-5#i...

Shale Boom in Texas Could Increase U.S. Oil Output

http://www.nytimes.com/2011/05/28/business/energy-environment/28shale.html?_r=1

Forget the Spin. Taxpayers Still on the Hook for Auto Bailouts

http://washingtonexaminer.com/opinion/2011/05/forget-spin-taxpayers-still-hoo...

Extreme Paranoia

http://theeconomiccollapseblog.com/archives/extreme-paranoia

Please prepare now for the beginning of the economic and social unrest.

The content contained in the Hyper Report is provided for informational purposes only. Use the information found in these videos as a starting point for conducting your own research and before making any significant investing decisions. All stories are sourced and assumes all information to be truthful and reliable; however, I cannot and do not warrant or guarantee the accuracy of this

information.

This video is protected by the Fair use Act-Title 17 Chapter 1, Article 107 pertaining to the use of copyrighted works to illustrate

an opinion, or for educational purposes...

Thank you.

Forex @ DailyFX - Crude Oil Likely to Decline While Gold Gains on Soft US Economic Data

Forex @ DailyFX - Crude Oil Likely to Decline While Gold Gains on Soft US Economic Data

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

Crude Oil Consolidation to Yield to Renewed Selling

WTI Crude Oil (NY Close): $100.59 // +0.36 // +0.36%

Prices continue to consolidate below the 38.2% Fibonacci retracement of the drop from the May 2nd high at $102.35. A break above this boundary exposes the 50% level at $104.73. Broadly speaking, anything shy of that keeps the overall structure broadly bearish. Near-term support stands at the psychologically significant $100 figure, followed by the 5/6 low at $94.65.

A quiet session is ahead, with futures markets closing early in the US for the Memorial Day holiday. Prices came under pressure overnight, which newswires chalked up to positioning ahead of this week’s packed US economic calendar that threatens to show the world’s top economy is meeting with strong headwinds. Most critically, separate reports are expected to show that growth in the US manufacturing sector slowed for the third consecutive month in May to the weakest pace since October 2010 while the economy added just 185,000 jobs, the least since January.

Indeed, a Citigroup index tracking positive US economic surprises suggests the trend in data releases has been pointing to steadily deterioration. The rapid approach of the expiration of QE2 – set to conclude with the Fed’s final bonds purchase on June 9 – ought to compound downward pressure. As we have suggested repeatedly over recent weeks, the program’s end is likely to precede a rise in US borrowing costs through the second half of the year, which is likely to unleash a short-term unwinding of bets on a range of risky assets (including crude) as well as long-term downward pressure on economic growth when it is already clearly fragile.

Commodities – Metals

Gold to Extend Rebound Amid Risk Aversion

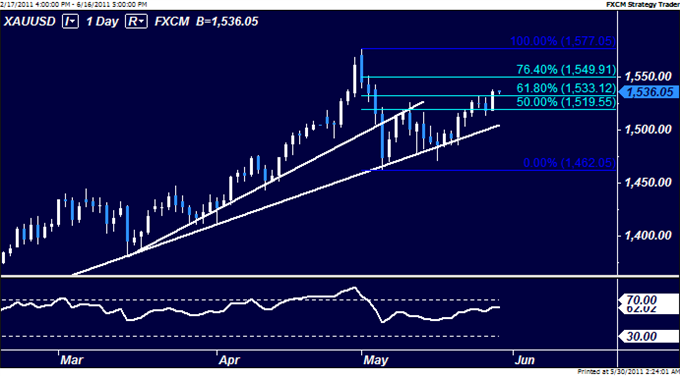

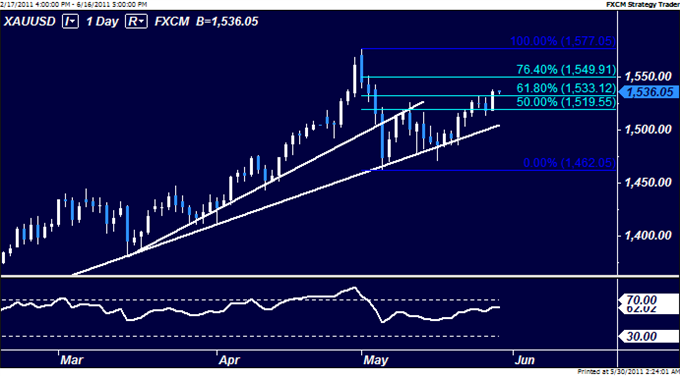

Spot Gold (NY Close): $1536.40 // +17.25 // +1.14%

Prices have taken out resistance at $1533.12, the 61.8% Fibonacci retracement of the drop from the May 2 high, clearing the way for an advance to the 76.4% level at $1549.91. The 61.8% Fib has been recast as near-term support, with a break back below that targeting the 50% retracement at $1519.55.

Gold’s recently rediscovered role as a safe haven asset may allow the metal to rise this week if the pessimism felt overnight about the upcoming set of US economic releases persists upon the return of liquidity to the markets following the Memorial Day holiday. The reemergence of Euro Zone sovereign risk fears over the weekend further bolster the case for short-term gains. Greek CDS rates hit the highest in a week overnight after Der Spiegel reported the country would not meet any of the fiscal goals set out in the terms of the EU/IMF bailout deal.

Spot Silver (NY Close): $37.99 // +0.69 // +1.86%

Prices are wedged between $36.44 and $38.99, the 23.6% and 38.2% Fibonacci retracements of the 4/25-5/6 decline, respectively. The correlation between gold and silver remains iron-clad, hinting the cheaper metal is likely to follow its more expensive counterpart higher if risk aversion grips financial markets anew. As we have noted previously, a significant inverse correlation between the gold/silver ratio and the S&P 500 hints the yellow metal will outperform if a flight to safety materializes.

For real time news and analysis, please visit http://www.dailyfx.com/real_time_news

Peter Schiff On Dollar Confidence, China Buying Portugal's Debt & QE3

May 27, 2011

May 26 2011 Fast Money CNBC -- Peter shiff

`It's Not Possible' for Greece to Repay Its Debts...Grant Says

May 27, 2011

May 25 (Bloomberg) -- Mark Grant, managing director at Southwest Securities Inc., and Nobel Prize-winning economist Robert Mundell of Columbia University talk about the outlook for Mario Draghi as president of the European Central Bank, the role of gold in the global monetary system and the possibility that Greece may withdraw from the euro. They talk with Pimm Fox on Bloomberg Television's "Taking Stock."

Friday 27 May 2011

What the common Chinese know about silver

May 22, 2011

Performed a random field study to find out what the common Chinese know about silver in Shanghai

Subscribe to:

Posts (Atom)