Energy ETFs Shoot Higher as Oil Revisits $100

July 22nd at 2:17pm by John Spence

Energy exchange traded funds have rallied over the past month as oil prices grind their way back to $100 a barrel and the sector ETFs extend their market lead.

Energy Select Sector SPDR Fund (NYSEArca: XLE) is up 8.2% over the past month, compared with a 3.9% gain for the S&P 500. Year to date, the energy ETF has climbed 17% while the broader market has advanced 8%, according to Morningstar.

Energy ETF holding Chevron (NYSE: CVX) is up more than 20% so far in 2011. The rally in the top Dow component is one reason why the index is outperforming the S&P 500 this year.[Why Dow Industrial ETFs are Beating the S&P 500 This Year]

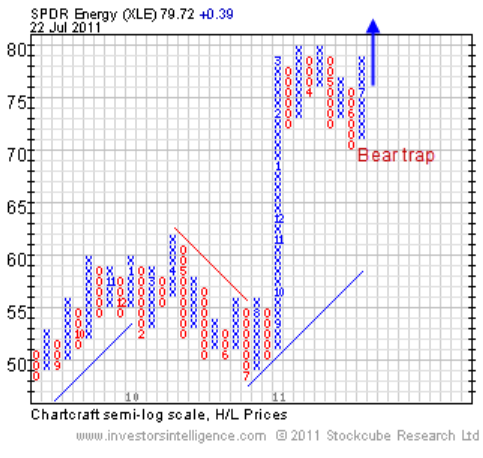

The energy ETF “is outperforming today with the point and figure (P&F) price chart nearing a spread triple-top breakout, a move which would notch a new 2011 high. Beyond that we would look for a test of the 2008 high, also the all-time high, at $91.42 a share,” according to the Coe Report, a newsletter from Investors Intelligence.

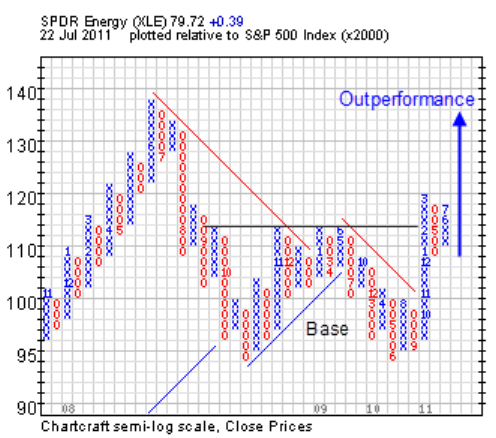

“Just as compelling is the P&F relative chart for XLE versus the S&P 500. That ratio exhibits a ‘W’ bottom, effectively a base which implies a relative move to the 2008 high, equating to further outperformance in the months ahead,” the newsletter said Friday.

Energy ETFs have been a sector leader over the past two weeks, according toStockCharts.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

No comments:

Post a Comment