Gold & Silver Outlook – 5 May

Gold and silver continue to fall for the third straight day; let's examine the precious metal market for today, May 5th:

Gold and silver– May

Gold reached yesterday 1,515$ a decline of 1.63%, while silver reached 39.39$ a drop of 7.51%.

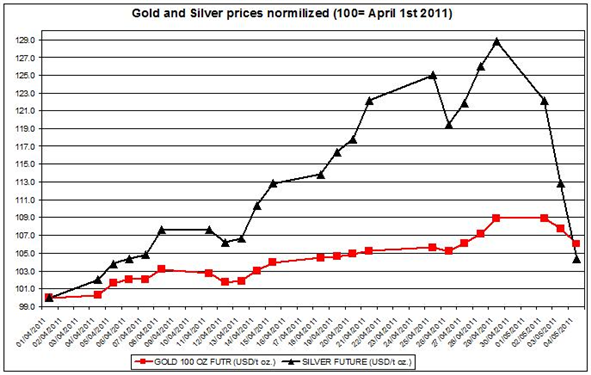

During May, silver decreased by 19%, while gold decreased by 2.6%. Notice as seen in the chart below, in normalized terms (100= April 1st) silver declined to a similar level gold are currently at.

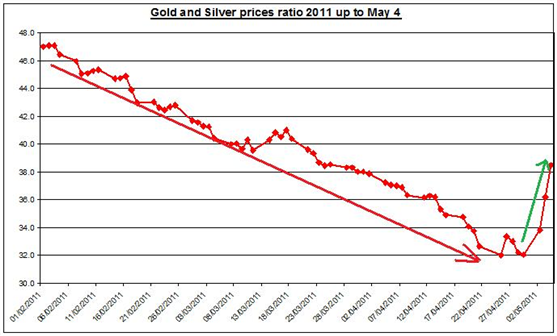

As of yesterday, May 4th the ratio between gold and silver rose to 38.47. The ratio could be interpreted as one troy ounce (31.1 gram) of gold is worth 38.47 troy ounces of silver.

The gold to silver ratio rose very rapidly by over 20% during May. This shift in trend is the first one in 2011.

The Effect of the Increase in Silver Margins

CME Group raised the margin requirements on silver trading at the beginning of the week. This was the second margin increase within a week's time. Under the recent terms the minimum amount needed to deposit will be 16,200$ per contract, an increase of 11.6% from the pervious amount needed. The ramifications of that announcement seem very clear as silver, as presented above deseeded very precipitately during the week.

The Fed Chairman's Speech

Ben Bernanke is set to speak today. The title of his speech is "Implementing a Macro prudential Approach to Supervision and Regulation ".

In this speech, he might also refer to the progress of the US economy and the stimulus plan that Fed is implementing. During last week, the news about the US economy's slowdown and the Fed's pledge to continue the quantitative easing plan might have be among the reasons for the rapid increase in gold and silver by the end of last week.

The US dollar

As presented in the monthly analysis about gold and silver, the weak dollar compared to major currencies probably contributed to the rise in gold and silver during April, but the current weakness in the US dollar seem to have taken the back seat in affecting these precious metals' prices. This is due to the rise in the effect of other factors as presented above.

The News on the Demise of Bin Laden

The news on the killing of head of al-Qaida - Osama Bin Laden continues to occupy the news in the following days to come. The initial reaction to this breaking news on the financial markets and major commodities markets dissipated and currently the financial markets seem stabilize and are now being affected by other factors.

Update from Middle East

Currently most of the Libyan fighting takes place in the rebel-held city of Misrata where Gaddafi's forces continue to strike the rebels.

Gold and silver Outlook and Analysis:

The freefall of silver seems to level out today and silver is traded at a moderate rate change which might continue throughout the day. The correction made in silver with the increase in of CME margin might be over as silver price declined to the levels gold price are at in terms of normalized prices as seen above. Nevertheless, gold and silver might continue to decline vis-à-vis the news about bin Laden's demise.

Here is a reminder of the top events and reports that are planed for today (all times GMT):

Today

13.30 – Department of Labor report – US unemployment claims

14.30 – Ben Bernanke, Chairman of Fed, speaks

15.30 – EIA report about Natural gas storage

Tomorrow

12.00 – Canada unemployment rate report

13.30 – US unemployment rate report & non-farm employment change

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

No comments:

Post a Comment