Silver Rush Spreads to Stock Market

by Tom Lauricella and Carolyn Cui

Wednesday, April 27, 2011

Wednesday, April 27, 2011

The mania for silver has spread to the stock market as day traders pile into the buying.

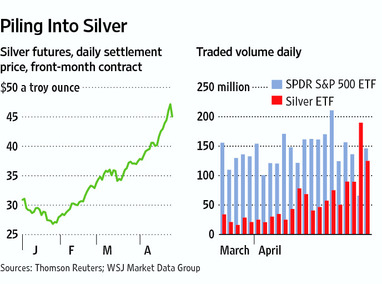

Trading got so heated during the past two days that shares traded in the iShares Silver Trust, the biggest exchange-traded fund tracking the price of silver, topped that of the SPDR S&P 500 ETF, usually one of the most actively traded securities in the world.

Day traders "are going crazy," says Joseph Saluzzi, co-head of trading at brokerage firm Themis Trading. "It's typical of the bubbly speculation that's been going on in silver."

On Monday, trading in the silver ETF was especially heavy, as silver prices soared to new 31-year highs and approached $50 an ounce. Silver is up 46% this year, part of a nine-month rally. The heavy ETF trading continued on Tuesday, as silver prices retreated.

[More from WSJ.com: Shiller vs. Siegel: Are Stocks Cheap or Dear]

Volume in the silver ETF on Monday reached a record 189 million shares, compared with an unusually low 65 million for the SPDR. The trading in the silver ETF was five times that of the 37 million daily average of the first quarter and blew past its previous daily peak of 149 million shares set in early November. On Tuesday, the silver ETF's trading was 125 million shares, falling just 21 million short of the SPDR volume.

The volume in silver ETFs is remarkable because the ETF until recently was relatively small and was shunned by mainstream traders. Its ascent reflects a surge in appetite for silver, which itself is reflecting a rise in the price of gold.

Investors have turned to precious metals amid worries about inflation and the weakness in the U.S. dollar. The metals are increasingly considered attractive as a permanent store of value that doesn't diminish like paper currencies.

Trading volume of silver futures contracts on the commodities exchange owned by CME Group rose to 319,205 contracts on Monday, a 58.6% jump from its prior record hit in November. Month to date, the contract's average daily volume has more than tripled compared with the same period last year. Total outstanding contracts in the silver-options market also reached a record on Monday.

[More from WSJ.com: A Guide to Fed Chairman's First Q&A ]

The heavy trading interest came as silver closes in on its record price of $48.70. Silver touched an intraday high of $49.105 per ounce on Monday before settling at $47.1510, a 31-year high. It dropped 4.4% to $45.0580 on Tuesday.

In some respects, the surge in silver ETF volume above the SPDR was made easier by relatively lack of volume in the SPDR fund.

Many investors have been sitting on the sidelines ahead of a crucial Federal Reserve meeting Wednesday. Trading also was muted Monday by a holiday across most of Europe.

The evidence of day-traders flocking to silver can be seen in the surge of trading in high-octane ETFs designed to magnify the moves in silver prices up or down. Trading in ProShares UltraShort Silver, an ETF that offers a levered bet on falling silver prices, totaled more than nearly eight times its average daily volume over the last three months. The fund is down more than 40% in 2011.

Scott Redler, chief strategic officer at T3 Trading Group, says day traders started to buy into silver ETF trading when silver prices first broke higher two weeks ago.

[More from WSJ.com: Computers, Too, Can Give Away Location]

"When that happened, momentum traders put it on their radar," Mr. Redler said.

It hasn't been one-way bet, however. Mr. Redler was among those last week selling borrowed shares of the iShares ETF in anticipation of buying them back at a lower prices later and pocketing the difference.

But, he says, so many traders were looking to do the same trade that, starting last Wednesday, "it was really tough" to locate shares to borrow.

"You had to 'get on line,"' for the shares, he says.

Part of the most recent surge in silver prices was the result of those bearish traders scrambling to buy in order to cover short positions.

On Monday, "we saw a lot of the shorts capitulate," Mr. Redler says.

Write to Tom Lauricella at tom.lauricella@wsj.com and Carolyn Cui at carolyn.cui@wsj.com

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

No comments:

Post a Comment