Electric Vehicles: The New Zeitgeist?

Sometimes when I review headlines and find one that I think fits a Seeking Alpha column, I end up feeling as if I am writing for the Onion. If it's not Al Franken, it's the President of the United States wasting his time, our time, and the Department of Justice's time. President Obama continues to feed Americans comical lines by notingthat he will "root out" (new boss, same as the old boss?) improprieties in oil markets in an attempt to save Americans from high gas prices. Obama can't seem to go anywhere these days withoutbringing up electric vehicles (EVs).

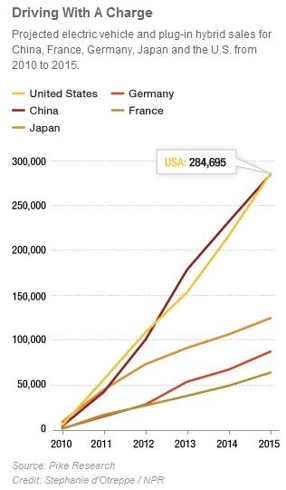

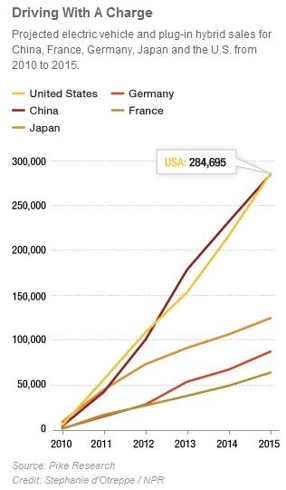

Click to enlarge:

If Obama knew what was good for his apparently green agenda (or if he actually had a true green agenda), he would not have summarily dismissed the Bowles-Simpson deficit reduction plan that he asked for. The plan, among other things, calls for a hike in the nation's gas tax. Of course, the mere suggestion of this brands the messenger acomplete fool. That said, higher gas prices would actually further Obama's alternative vehicle agenda, if it were actually more than superficial and feel-good rhetoric aimed at the anti-war left he abandoned after winning the election.

That said, regardless of the obvious shortcomings in Washington, I feel serious synchronicity building around the EV movement. March vehicle sales showed that the growth most carmakers experienced came thanks to consumers buying more fuel-efficient vehicles. And automakers, big and small, appear to finally be getting serious about improving gas mileage as well as developing and bringing to market smaller cars and alternatives to the internal combustion engine.

Just as a massive number of consumers have latched onto smaller, more fuel-efficient cars and significant numbers have purchased hybrids, EVs will gain traction as their exposure broadens. That's happening now. This type of zeitgeist tends to develop in a few, very predictable stages.

First, the well-heeled and excessively green-minded do-gooders become early adopters of the next big thing. Nissan (NSANY.PK) sold out its first run of the all-electric Leaf. Second, a politician or two beats the drum, which precedes an onslaught of media coverage of the topic. And third, the masses pick up on the vibe and slowly begin to investigate the option. It certianly helps when companies with loads of social cache like BMW announce plans to roll out EVs. Last, large enough numbers jump aboard -- as happened with hybrids, particularly Toyota's (TM) Prius -- that, while still a niche, it's sizable enough to no longer be cast off by critics and pundits as a fad.

The buzz described in the preceding paragraph exists all around us. I have covered the first two points here and in previous Seeking Alpha articles. The final phase is just getting underway in concert with the ramping up of political and sociocultural attention.

If Obama knew what was good for his apparently green agenda (or if he actually had a true green agenda), he would not have summarily dismissed the Bowles-Simpson deficit reduction plan that he asked for. The plan, among other things, calls for a hike in the nation's gas tax. Of course, the mere suggestion of this brands the messenger acomplete fool. That said, higher gas prices would actually further Obama's alternative vehicle agenda, if it were actually more than superficial and feel-good rhetoric aimed at the anti-war left he abandoned after winning the election.

That said, regardless of the obvious shortcomings in Washington, I feel serious synchronicity building around the EV movement. March vehicle sales showed that the growth most carmakers experienced came thanks to consumers buying more fuel-efficient vehicles. And automakers, big and small, appear to finally be getting serious about improving gas mileage as well as developing and bringing to market smaller cars and alternatives to the internal combustion engine.

Just as a massive number of consumers have latched onto smaller, more fuel-efficient cars and significant numbers have purchased hybrids, EVs will gain traction as their exposure broadens. That's happening now. This type of zeitgeist tends to develop in a few, very predictable stages.

First, the well-heeled and excessively green-minded do-gooders become early adopters of the next big thing. Nissan (NSANY.PK) sold out its first run of the all-electric Leaf. Second, a politician or two beats the drum, which precedes an onslaught of media coverage of the topic. And third, the masses pick up on the vibe and slowly begin to investigate the option. It certianly helps when companies with loads of social cache like BMW announce plans to roll out EVs. Last, large enough numbers jump aboard -- as happened with hybrids, particularly Toyota's (TM) Prius -- that, while still a niche, it's sizable enough to no longer be cast off by critics and pundits as a fad.

The buzz described in the preceding paragraph exists all around us. I have covered the first two points here and in previous Seeking Alpha articles. The final phase is just getting underway in concert with the ramping up of political and sociocultural attention.

Click on charts to enlarge:

Source: Bloomberg, 04/19/2011

Source: Fox Business News, 04/18/2011

Source (Above): Frost & Sullivan, 06/04/2010 Source (Below): NPR, 10/13/2010

What does it mean for investors? Broadly speaking, pay attention to the space and look for ways to play it. In addition to the aforementioned evolving and somewhat overlapping turn of events, I think investors should keep several names and events on their radar screens.

Charging Stations

I have written about EV charging stations before. This could be the best play on the EV space. Several companies appear serious about generating revenue by providing the key infrastructure necessary to make EVs viable for a larger number of Americans. NRG Energy (NRG) will have 120 EV charging stations in place in Houston and Dallas by summer. This move represents just a small slice of the many other EV charging station initiatives moving forward nationwide. But NRG, as a well-positioned diversified company, provides one of the safest ways to play what amounts to the infrastructure preceding significant EV adoption. Don't be surprised if a company like NRG takes out Coulomb Technologies, a private company located near San Jose, California, that is doing a more thanan impressive job penetrating markets.

Dedicated Dealerships

Write down the name Michael Dezer. He's a multi-billionaire who is close, at least from a real estate mogul standpoint, with Donald Trump. Multiple sources confirm that Dezer is about to either buy out, make a significant investment in, or forge a meaningful partnership with an OTC billboard-listed company that aims to roll out dealerships that specialize in EVs and other alternative fuel vehicles nationwide. If this happens, it's significant for the EV space on a couple of key counts. Obviously, a company that only sells green vehicles will get lots of national and/or regional publicity. It could also raise the eyebrows of the major automakers as well as CarMax (KMX) and AutoNation (AN), two companies which could easily fit a few all-alternative dealerships into markets such as California, Florida, or Texas.

Key Earnings

Tesla (TSLA) reports earnings on May 4th. Since Morgan Stanley upgraded the company to the moon, its shares have traded in a relatively stagnant range. This will be a key earnings report for the company. Tesla has warned investors to expect a lull in sales between the end of its Roadster hype and its 2012 launch of the more affordable Model S. How it intends to fill that gap, if at all, will prove crucial to not only the stock, but Tesla's ability to not fall behind its better-positioned competition. Best case, but unlikely scenario: Tesla announces the Model S will be available sooner than expected. Good and more realistic scenario: Tesla announces more deals to provide other automakers with EV components. Good and more realistic scenario number two: Tesla announces a sharp increase in Model S deposits. Worst case scenario: They announce none of the above.

In addition, Nissan reports on May 6th. It will be interesting to see if it updates production plans or demand for the Leaf, now that it is thecar of the year.

Political Landscape

Despite Obama's dog and pony show, the federal tax credit for purchasing an EV can't be maligned. Particularly when you consider the premium consumers must pay for a car like the Leaf. As of now, the credit will not last forever. What happens politically in America over the next couple of years could impact not only sales, the escalating buzz around EVs. If Obama or somebody like him wins reelection, I could see the credit receiving an extension into 2015 and even beyond. A Republican victory does not necessarily mean the end to EVs. If somebody like Sarah Palin becomes President, I would not hold my breath. But, a victory by somebody like Trump could actually be a boon for EVs. First, there's the above-mentioned Michael Dezer connection. And, while I don't know much about Trump's social views other than he now apparently tends toward conservative, I would not be shocked to see him more than willing to jump on the EV bandwagon if he sees a viable economy there. As he has said himself, he's a New Yorker, so like Michael Bloomberg, he sometimes plays the East Coast urbanite's game.

Source: Bloomberg, 04/19/2011

Source: Fox Business News, 04/18/2011

Source (Above): Frost & Sullivan, 06/04/2010 Source (Below): NPR, 10/13/2010

What does it mean for investors? Broadly speaking, pay attention to the space and look for ways to play it. In addition to the aforementioned evolving and somewhat overlapping turn of events, I think investors should keep several names and events on their radar screens.

Charging Stations

I have written about EV charging stations before. This could be the best play on the EV space. Several companies appear serious about generating revenue by providing the key infrastructure necessary to make EVs viable for a larger number of Americans. NRG Energy (NRG) will have 120 EV charging stations in place in Houston and Dallas by summer. This move represents just a small slice of the many other EV charging station initiatives moving forward nationwide. But NRG, as a well-positioned diversified company, provides one of the safest ways to play what amounts to the infrastructure preceding significant EV adoption. Don't be surprised if a company like NRG takes out Coulomb Technologies, a private company located near San Jose, California, that is doing a more thanan impressive job penetrating markets.

Dedicated Dealerships

Write down the name Michael Dezer. He's a multi-billionaire who is close, at least from a real estate mogul standpoint, with Donald Trump. Multiple sources confirm that Dezer is about to either buy out, make a significant investment in, or forge a meaningful partnership with an OTC billboard-listed company that aims to roll out dealerships that specialize in EVs and other alternative fuel vehicles nationwide. If this happens, it's significant for the EV space on a couple of key counts. Obviously, a company that only sells green vehicles will get lots of national and/or regional publicity. It could also raise the eyebrows of the major automakers as well as CarMax (KMX) and AutoNation (AN), two companies which could easily fit a few all-alternative dealerships into markets such as California, Florida, or Texas.

Key Earnings

Tesla (TSLA) reports earnings on May 4th. Since Morgan Stanley upgraded the company to the moon, its shares have traded in a relatively stagnant range. This will be a key earnings report for the company. Tesla has warned investors to expect a lull in sales between the end of its Roadster hype and its 2012 launch of the more affordable Model S. How it intends to fill that gap, if at all, will prove crucial to not only the stock, but Tesla's ability to not fall behind its better-positioned competition. Best case, but unlikely scenario: Tesla announces the Model S will be available sooner than expected. Good and more realistic scenario: Tesla announces more deals to provide other automakers with EV components. Good and more realistic scenario number two: Tesla announces a sharp increase in Model S deposits. Worst case scenario: They announce none of the above.

In addition, Nissan reports on May 6th. It will be interesting to see if it updates production plans or demand for the Leaf, now that it is thecar of the year.

Political Landscape

Despite Obama's dog and pony show, the federal tax credit for purchasing an EV can't be maligned. Particularly when you consider the premium consumers must pay for a car like the Leaf. As of now, the credit will not last forever. What happens politically in America over the next couple of years could impact not only sales, the escalating buzz around EVs. If Obama or somebody like him wins reelection, I could see the credit receiving an extension into 2015 and even beyond. A Republican victory does not necessarily mean the end to EVs. If somebody like Sarah Palin becomes President, I would not hold my breath. But, a victory by somebody like Trump could actually be a boon for EVs. First, there's the above-mentioned Michael Dezer connection. And, while I don't know much about Trump's social views other than he now apparently tends toward conservative, I would not be shocked to see him more than willing to jump on the EV bandwagon if he sees a viable economy there. As he has said himself, he's a New Yorker, so like Michael Bloomberg, he sometimes plays the East Coast urbanite's game.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: Author has held a substantial long position in EVCARCO, the OTCBB company referenced in the article, since 2010. Author may initiate a long position in TSLA, via the stock or options, after the company reports earnings in May.

Additional disclosure: Author has held a substantial long position in EVCARCO, the OTCBB company referenced in the article, since 2010. Author may initiate a long position in TSLA, via the stock or options, after the company reports earnings in May.

All information on this website is for educational purposes only and is not intended to provide financial advise. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold MinKL Invest harmless in any and all ways.

No comments:

Post a Comment